Navigating the Top NRE Accounts in India: A Guide for Non-Resident Indians

As a Non-Resident Indian (NRI), finding the perfect NRE account that caters to your financial needs can feel like striking gold. However, with numerous banks offering NRE accounts in India, the selection process can be overwhelming. This comprehensive guide aims to simplify your decision-making by exploring the key features, benefits, and drawbacks of the top NRE accounts available in India.

Understanding NRE Accounts and Their Significance

An NRE account, or Non-Resident External account, is a specialized savings account designed specifically for NRIs. It allows you to deposit and manage your income earned outside of India in Indian Rupees (INR). The benefits of having an NRE account include tax-efficient savings, full repatriability of funds, and the flexibility to manage your money in Indian currency.

Eligibility and Documentation Requirements

To open an NRE account, you must be an NRI or a Person of Indian Origin (PIO). The necessary documentation typically includes a valid passport, proof of overseas address, recent photographs, and a completed account opening form.

Top NRE Accounts in India

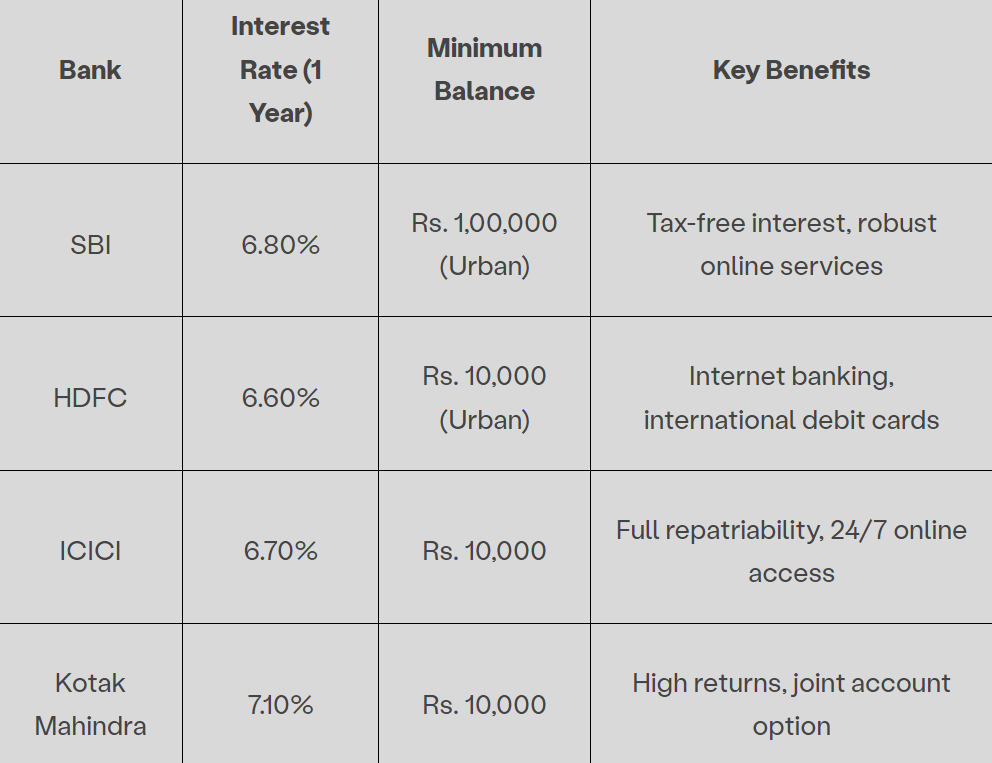

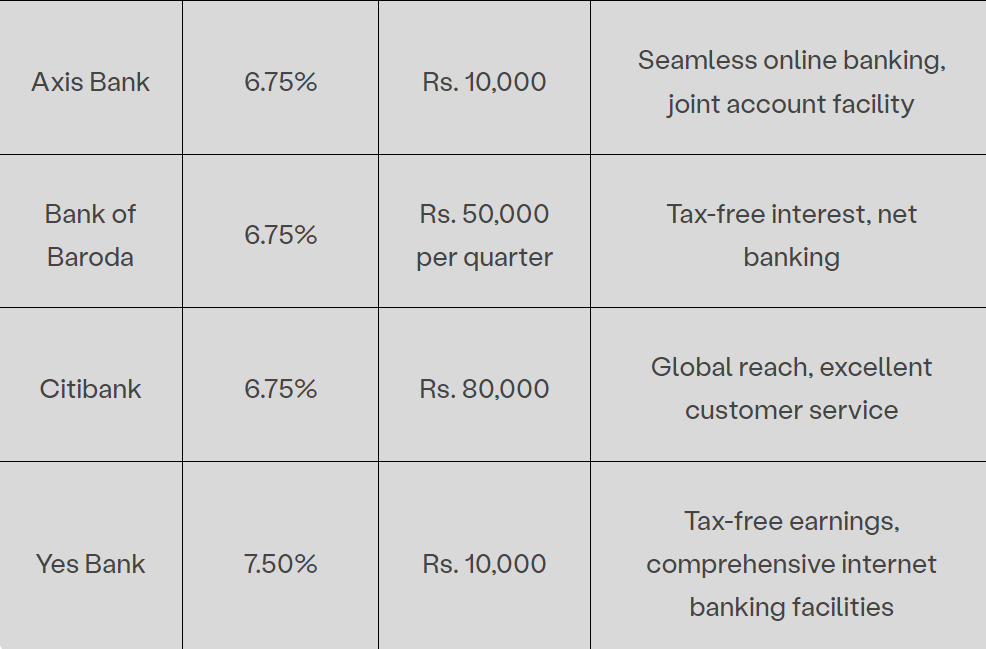

This guide delves into the details of some of the best NRE accounts in India, covering their benefits, interest rates, and other key features to help you make an informed decision.

SBI NRE Account, HDFC NRE Account, ICICI NRE Account, Kotak Mahindra Bank NRE Account, Axis Bank NRE Account, Bank of Baroda NRE Account, Citibank NRE Account, and Yes Bank NRE Account.

A comparison table highlighting the interest rates, minimum balance requirements, and key benefits of each bank’s NRE account is provided for easy reference.

10 Factors to Consider When Choosing the Best NRE Account

- Compare Interest Rates: Look for an NRE account with a competitive interest rate to maximize your returns.

- Mind the Fees: Avoid hidden charges and choose an account with minimal maintenance or transaction fees.

- Prioritize Customer Service: Opt for a bank known for its helpful and responsive customer support.

- Go Digital: Ensure the bank offers user-friendly online and mobile banking for convenient account management.

- Match Your Needs: Decide if you need easy access (savings account) or better long-term returns (fixed deposit).

- Consider Transaction Habits: Choose an account with minimal fees if you plan on frequent withdrawals or online transactions.

- Mandate Holder Option: If you’re not in India, pick a bank that allows appointing someone to manage your account.

- Shop Around & Compare: Research different banks and compare features, fees, and interest rates before making a decision.

- Read the Fine Print: Understand all terms and conditions associated with the NRE account before signing up.

- Plan for the Future: Think about your long-term financial goals in India and choose an NRE account that offers the flexibility you might need.

Conclusion

Selecting the best NRE account in India can be a game-changer for NRIs managing their finances from abroad. By considering the factors discussed in this guide and utilizing the expert tips, you’ll be well-equipped to choose the perfect NRE account that empowers you to achieve your financial goals.

FAQs’

Q1. What are the key features to look for in an NRE account for NRIs? Ans- The key features to look for include tax benefits, full repatriability, competitive interest rates, easy online and mobile banking access, and minimal maintenance fees.

Q2. Which banks offer the best online and mobile banking facilities for NRE account holders? Ans- Banks like HDFC, ICICI, and Citibank are known for their excellent online and mobile banking facilities for NRE account holders.

Q3. Are there any notable differences in the fees banks charge for maintaining an NRE account? Ans- Yes, fees can vary significantly. Some banks may have higher minimum balance requirements or additional charges for certain services. It’s important to compare these aspects when choosing an NRE account.

Q4. Which bank helps to manage NRE accounts while living abroad? Ans- Banks like SBI, HDFC, and ICICI provide robust online services and dedicated customer support to help manage NRE accounts efficiently while living abroad.

Q5. What are the unique benefits or features provided by different banks for their NRE account holders? Ans- Each bank offers unique features such as higher interest rates, dedicated relationship managers, seamless online banking, tax-free interest, and joint account options. For example, Yes Bank offers personal relationship managers, while Kotak Mahindra Bank provides high returns on deposits. It is up to the individual to make an informed decision.

Q6. How are currency exchange rates managed in NRE accounts? Ans- NRE accounts convert your foreign currency deposits into Indian Rupees (INR) at current exchange rates. When you transfer money back to a foreign account, it’s converted based on the exchange rate at that time.

Q7. Can NRIs open a joint NRE account with a resident Indian? Ans- Yes, NRIs can open a joint NRE account with a resident Indian, typically a close relative, but the NRI must be the primary account holder.

Q8. What happens to my NRE account if I move back to India? Ans- If you return to India permanently, your NRE account should be converted into a resident savings account or a Resident Foreign Currency (RFC) account.

Q9. Are there any withdrawal limits from NRE accounts in India? Ans- No, there are no restrictions on withdrawing funds from an NRE account in India. You can freely withdraw in INR, and the funds can be fully repatriated to a foreign account.

Q10. What are the advantages of using an NRE account for investments in India? Ans- NRE accounts offer tax-free interest, full repatriability, easy online management, and a convenient way to invest in Indian assets while living abroad.