Navigating Currency Conversion Fees: Canada to India Remittances

An interesting fact: The digital remittance market in Canada reached approximately $1.98 billion in 2024 and is projected to grow to $2.15 billion by 2028. This highlights the importance of understanding the costs associated with international money transfers.

A significant factor influencing the amount your family receives in India is the currency conversion fee. These charges can accumulate and diminish the total sum sent.

In this article, we’ll examine how currency conversion fees impact remittances from Canada to India, explain their calculation, discuss avoidance strategies, and compare various remittance services.

Understanding Currency Conversion Fees in Remittances

Currency conversion fees are charges levied by financial institutions or remittance service providers for exchanging one currency for another. These fees cover the cost of facilitating the exchange and can vary significantly among service providers.

For instance, if you use a service like Western Union to transfer $1,000 CAD to India, a 2% conversion fee might be applied. This would result in an additional $20 CAD being deducted from your remittance, reducing the amount received by your family.

These conversion fees can accumulate rapidly, especially for frequent remittances, making it crucial to understand their mechanics and impact on your transfers.

Recent Trends in Currency Conversion

The remittance sector has recently experienced significant shifts in currency conversion trends. Here’s an overview of the exchange rates affecting Canada to India remittances:

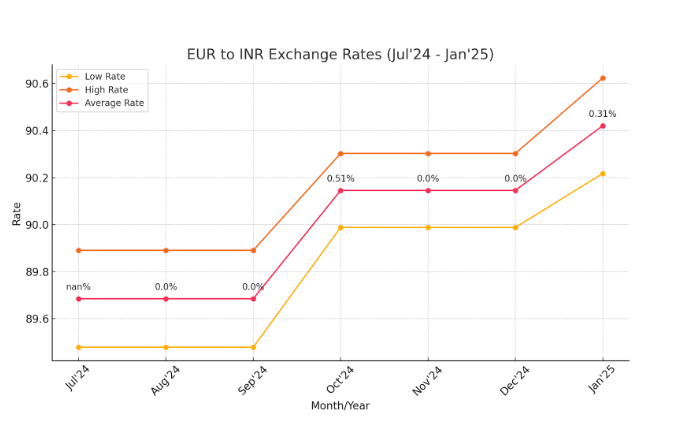

The chart illustrates that CAD to INR exchange rates have fluctuated considerably. These variations underscore the importance of timing when sending remittances.

Some days saw peak rates, offering better value, while others experienced dips, reducing the amount received by recipients. This volatility emphasizes the need for regular monitoring of exchange rates.

By staying informed and choosing optimal transfer times, you can maximize the benefits of your remittances and minimize the impact of currency conversion fees.

The Impact of Conversion Fees on Canada to India Remittances

Currency conversion fees can significantly affect the amount your family receives in India. When you send money, the remittance service provider typically converts your Canadian dollars (CAD) to Indian rupees (INR).

The exchange rate used for this conversion is often marked up from the mid-market rate, which is the rate banks use to trade currencies with each other. This markup, along with additional fees, reduces the total amount received by the recipient.

The mid-market rate is relevant here as it serves as the benchmark for the most accurate and fair exchange rate available.

Mid-Market Rate: This is the midpoint between the buy and sell rates of two currencies. It’s considered the most accurate exchange rate and is often used as a benchmark for currency conversion.

For example, if the mid-market rate is 1 CAD = 70 INR, but your bank or service provider offers 1 CAD = 68 INR, you lose 2 INR for every dollar sent. Additionally, a flat fee might be charged per transaction, further reducing the total remittance. These conversion fees can accumulate quickly, especially for frequent or large transfers.

Currency Conversion Costs for Canada-to-India Remittances

The cost of converting currencies for remittances from Canada to India varies widely. Banks and traditional remittance services typically charge higher fees and offer less favorable exchange rates compared to online transfer providers. The total cost usually includes:

- Exchange rate markup: The difference between the mid-market rate and the rate offered by the remittance service.

- Flat Fees: Additional charges per transaction, which can be a fixed amount or a percentage of the transfer value.

For instance, banks may charge a fixed fee of CAD 10-30 for each transaction, plus an exchange rate markup.

Variation in Fees Among Remittance Services

Fees indeed vary widely among different remittance services. Here are some key differences:

- Banks: Generally charge higher fees and offer less favorable exchange rates. They might also have additional charges for international wire transfers, making them one of the costliest options.

- Online Transfer Services: Companies often provide better exchange rates and lower fees. They use transparent pricing models, allowing you to see the total cost upfront.

- Offline partners: Companies like Western Union and MoneyGram offer competitive rates, but fees can vary based on the transfer method (e.g., cash pickup vs. bank transfer). While they offer the convenience of physical locations, they may have higher fees compared to online services.

To find the best deal, compare the total cost of the transaction, including both the exchange rate and any additional fees.

Strategies to Reduce Currency Conversion Costs

Minimizing currency conversion costs can ensure more of your money reaches your family in India. Consider these strategies:

- Compare Providers: Always examine the costs and currency rates of various remittance providers. Use comparison websites or tools to select the most cost-effective solution.

- Choose online services: Online transfer services such as Wise, Vance, OFX, and Remitly often offer better rates and lower fees than banks and traditional remittance providers.

- Send large amounts less frequently: If feasible, combine small transfers into larger ones. This can mitigate the impact of flat fees, which are often charged on every transaction.

- Avoid using Credit Cards: Using a credit card to fund your transfer may result in additional fees. Opt for direct bank transfers or debit card payments instead.

- Look for deals: Some remittance providers offer specials or discounts to first-time users or during specific seasons. Take advantage of these offers.

Conclusion

Currency conversion fees can significantly impact the amount of money received by your family in India. These hidden charges can accumulate, diminishing the total amount your loved ones receive.

By understanding these fees and comparing different remittance services, you can identify the true cost of each transaction and avoid unfavorable exchange rates.

Making informed decisions about remittance providers can potentially save you a considerable amount on your transfers, ensuring better financial support for your family.

FAQs’

1. How do currency conversion fees affect the exchange rate for Canada to India remittances?

Ans- Currency conversion fees decrease the effective exchange rate, resulting in the recipient receiving less money.

2. What are currency conversion fees, and why are they applied to remittances?

Ans- Currency conversion fees cover the expense of converting one currency to another and are imposed by banks and remittance services.

3. How can one compare currency conversion fees among different Canadian remittance services?

Ans- Compare the total cost, including the offered exchange rate and any additional fees, to determine the most cost-effective service.

4. What is the typical currency conversion fee for sending money from Canada to India?

Ans- The average fee varies but typically ranges from 1-3% of the total transaction amount.

5. How do currency conversion fees differ between banks and other remittance service providers in Canada?

Ans- Banks generally have higher fees and less favorable exchange rates compared to online transfer services and specialized remittance providers.

6. How can I minimize currency conversion costs?

Ans- Use online transfer services known for their competitive rates and low fees, and always compare different providers before making a transfer.

7. Can I avoid currency conversion fees when sending money to India?

Ans- No, but you can reduce them by choosing providers with low fees and better exchange rates.

8. How do I know if I’m getting a good exchange rate?

Ans- Compare the exchange rate offered by your service to the mid-market rate. The closer it is, the better the deal.

9. Is it cheaper to send money during certain times of the year?

Ans- Sometimes. Exchange rates can fluctuate, so sending money when rates are higher can save you money.

10.Do small transfers have higher fees?

Ans- Yes, small transfers may seem more expensive due to flat fees. Sending larger amounts less often can reduce costs.