How NRIs Can Unlock DTAA Benefits and Save on Taxes

What is Double Taxation?

If you are an Indian and a resident in another country(NRI) with multiple sources of income in both countries, you may be taxed twice – once in your resident country and once in India. There are additional methods to be double taxed.

For instance, if you reside in India and operate as a freelancer for a U.S.-based company, your income can be considered taxable in both countries. In India, you are a resident who earns income, whereas in the United States, your income may be subject to tax because its source is in the United States.

What is Double Tax Avoidance Agreement (DTAA)?

Paying taxes twice on a single source of income is not in the best interests of the individual. Consequently, India has signed the Double Tax Avoidance Agreement (DTAA) with numerous countries. Individuals can use this agreement’s provisions to avoid double taxation.

How can DTAA benefits be obtained?

You may receive DTAA benefits in the following ways:

1. Verify that the DTAA is in effect between the two countries in question.

2. Submit on schedule the following documents:

Certificate of Tax Residency – You must obtain a tax residency form from the government of the country in which you reside. It includes information such as name, status, nationality, address, and tax information.

Obtain the DTAA Application Form – Form 10F from the income tax department and have it validated by the government of your country of residence.

Self Declaration and Identity Form – A declaration indicating your country of residence during the applicable fiscal period and that DTAA applies to your situation.

Self-Attested copy of PAN Card

Self-Attested copy of passport

How is the DTAA benefit calculated and provided to an individual?

There are primarily three ways to claim tax relief under the DTAA:

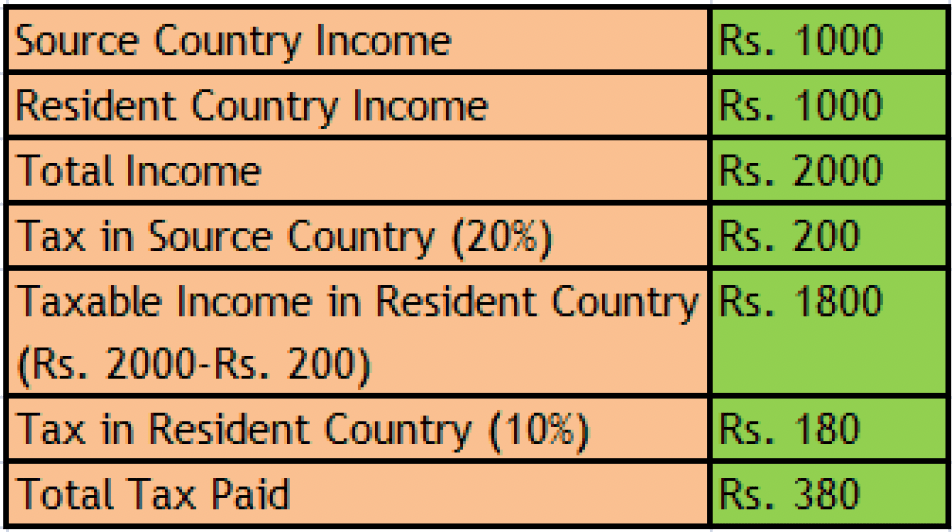

1. Exemption Method

The exemption method follows the Tax deducted at Source (TDS) method. Here, you are taxed in one country and exempted from tax in the other. Tax is deducted at source as per the rate applicable as per the DTAA agreement between India and the relevant country.

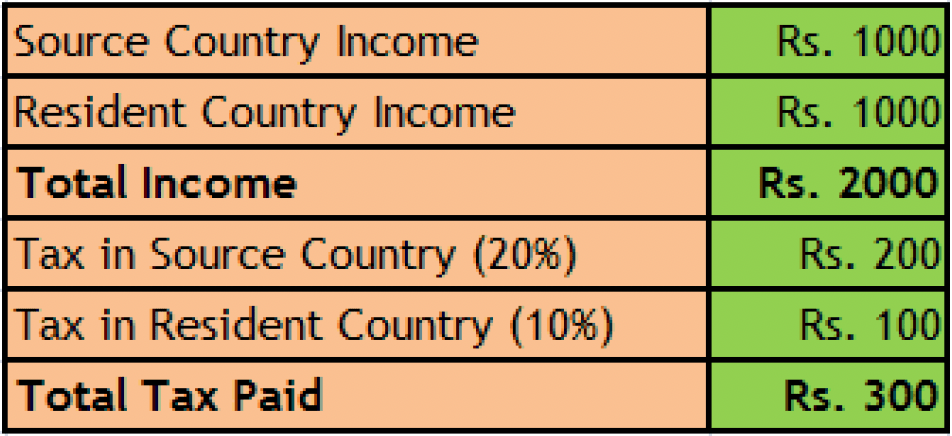

2. Deduction Method

In the deduction method, tax is paid in the country where income is earned and is subtracted from the total global income. Then tax is calculated on the difference and paid in the home country.

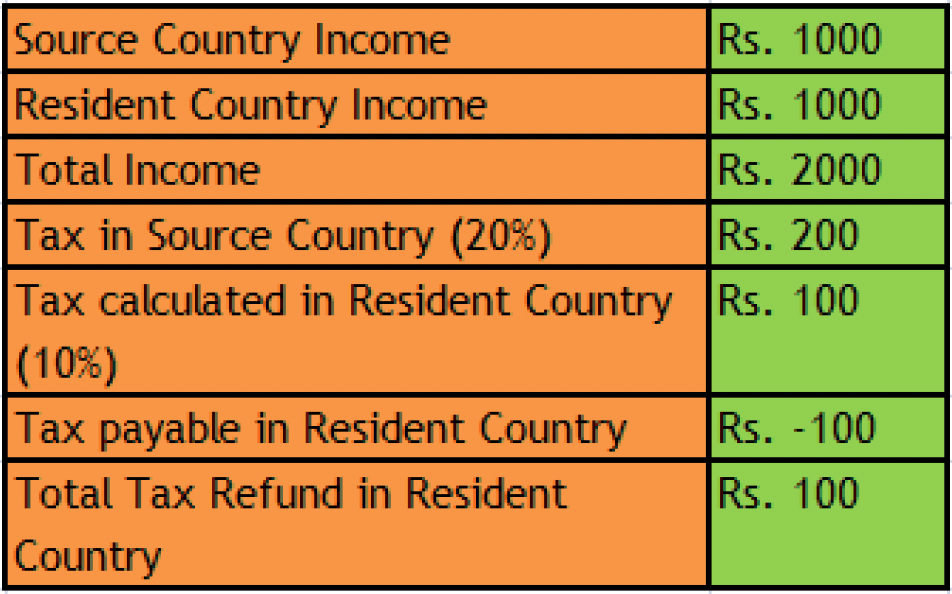

3. Tax credit method

In the tax credit method, total global income is taxed in the country where you reside. Then tax relief can be claimed from the country where the income is earned.

You can select the taxation method that is most beneficial to you. Example, you choose the exemption method if you have already paid taxes or use the deduction method when the tax rates are high in the other country that you are not residing in. DTAA is a provision that can be used to reduce tax burden. You should not evade paying tax but plan your taxes such that you pay as less as possible within the legal domain.