Axis Bank GIFT City US Dollar Fixed Deposits (FD) For NRIs: Know The Rates And Process

In a significant development for Non-Resident Indians (NRIs) looking for lucrative investment opportunities, Axis Bank has recently taken a pioneering step. On Tuesday, the bank unveiled its groundbreaking digital US dollar fixed deposit (FD) scheme for NRI customers at the International Financial Services Centre (IFSC) Banking Unit in GIFT City, Gujarat. This strategic move not only positions Axis Bank as the inaugural financial institution to offer such a digital journey for GIFT City Deposits but also marks a monumental shift in the realm of banking convenience and efficiency for NRIs.

Simplified and Streamlined Investment Process

Axis Bank’s innovative approach allows NRI customers to effortlessly open US dollar fixed deposits via ‘Open by Axis Bank,’ their comprehensive mobile banking application. This app offers an end-to-end paperless solution that eliminates the cumbersome need for physical documentation. NRIs can now initiate and manage their FD accounts from anywhere in the world, at any time, seamlessly integrating this investment option into their financial portfolio without geographical constraints.

Why This Matters for NRIs

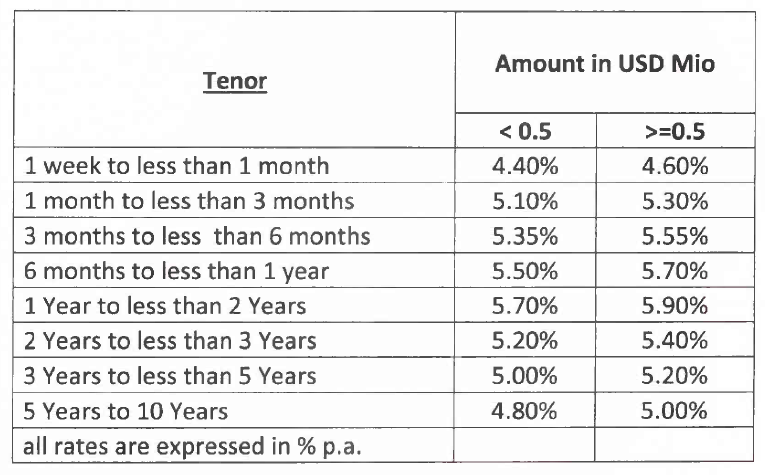

The allure of US dollar fixed deposits lies in their ability to offer a stable and attractive investment return, particularly in the volatile economic climate we navigate today. With Axis Bank’s competitive interest rates, NRIs are presented with one of the safest investment opportunities available in the market. The bank’s digital US dollar FDs come with a flexible range of investment tenures, from as short as seven days to as long as ten years, catering to the diverse financial planning needs and goals of NRIs.

Moreover, the convenience of managing the FD digitally, including the options for partial or full premature closure through the Axis Bank mobile application, empowers investors with greater control over their financial decisions. This level of autonomy and accessibility is crucial for NRIs who need to manage their investments dynamically in response to changing personal circumstances or market conditions.

Rates:

Source: https://www.axisbank.com/docs/default-source/default-document-library/faq.pdf

The Bottom Line

The launch of digital US dollar fixed deposits by Axis Bank at GIFT City is more than just a new banking product; it represents a paradigm shift towards more accessible, efficient, and flexible financial services for NRIs. As a financial advisor committed to guiding NRIs in navigating their investment journey, such innovations are key to unlocking new potentials and opportunities in the global financial landscape.

While the digital banking solutions like Axis Bank’s US dollar FD at GIFT City has made managing investments more accessible, the role of a financial advisor cannot be understated. Financial advisors provide personalized guidance to help NRIs understand the nuances of international investment options, including currency risks, tax implications, and compliance with regulatory requirements.