Personal Finance

- Home

- Personal Finance

- Page 8

Should You Invest Only in Best Performing Mutual Funds?

Many investors chase high returns and therefore are always on a lookout for best performing

3 Important Reasons to Do Retirement Planning With Mutual Funds?

Retirement Planning is a goal for many people. But just like usual, retirement as a

4 Reasons Why Businessmen and Entrepreneurs Should Invest in Equity Mutual Funds

General reaction of any businessmen or entrepreneur towards savings/investing is that his/her business generates huge

5 Key Questions That Mutual Fund Investors Should Ask

Once you identified mutual fund as your investment class, the next essential task is to

How Do Mutual Fund Pension Plans Work To Build Your Retirement Corpus?

Pension plans are a means of generating funds for the golden years of a person’s

What Happens to the Mutual Fund Units After the Investor Passes Away?

A nominee is someone who takes care of your assets and can claim these assets

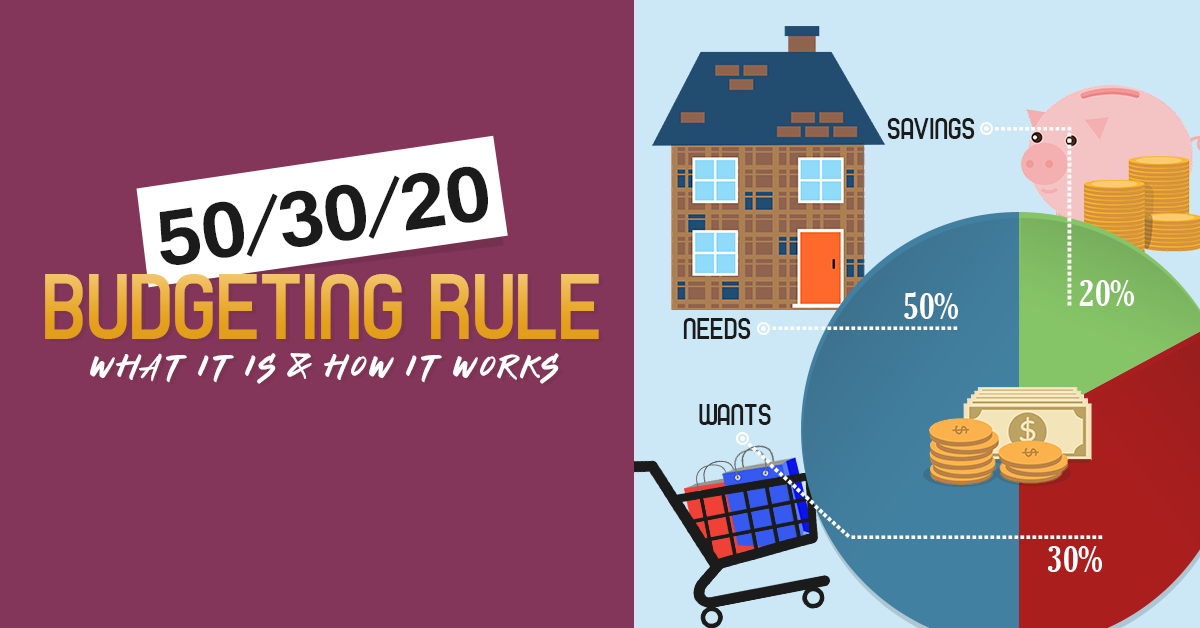

What is the 50/30/20 Rule of Budgeting?

Budgets should be about more than just paying your bills on time – the right

How Does LTGC (Long Term Capital Gains) Tax Affect You?

The Indian Government passed the Union Budget of 2018 with some changes in the fiscal

4 Types of Mutual Funds in India

Mutual Funds have gained major traction over the past decade. If you are considering investing

What is the Difference Between SIP, SWP and STP?

Often people get confused with the three terms, SIP, STP, and SWP, and end up

Tags

businessmen

Debt Funds

Dividend

equity mutual funds

Exit Load

FD

Fixed Deposits

fund investor

gift tax

gift tax rules

home loans

home loans in india

Investment

Investments

Long Term Capital Gains

multi asset

Mutual Fund

mutual fund investors

Mutual Fund Pension

mutual fund ratings

Mutual Funds

mutual funds for nris

mutual fund taxes

Mutual Fund Tax Saving Scheme

NAV

NAV Applicable

nri financial planning

nri financial planning in canada

nri home laons

nri loans

nri loans in india

nri personal loans

nris in canada

nris in usa

nri taxes

physical assets

PrimeWealth

Retirement Planning

rnor

SIP

SIP Investment Strategy

STP

SWP

tax benefits for nris

tax rules in india