Difference Between Direct Plan and Regular Plan

For those of you who have just started reading up about investing in mutual funds, common terms you may have come across the term that is Regular Plan and Direct Plan. This blog post talks about what Direct Plans are and what Regular Plans are, the difference between the two, and which one is better for you.

At the time when you invest money in mutual funds with the help of your bank, a friend, a relative, or an acquaintance who is an AMFI – registered Mutual Fund Distributor, you are essentially in a Regular Plan, and the person is assisting you with the investment is acting as a mediator or broker.

This means that every time you invest money in an equity fund with a Regular Plan, you shell out an expense ratio of 2-2.5% of the investment amount, the broker in question end up getting 1%-1.5% of this amount.

This same expense ratio comes down to 1.25%-1.5% in the case of the Direct Plans. Moreover, here, the firm or individual assisting you does not take any money from you in the form of brokerage. A saving of 1.5% every year in commission is huge!

To cut a long short story, a Direct Plan allows you to earn more money than a Regular Plan by cutting out middlemen commissions or brokerage fees.

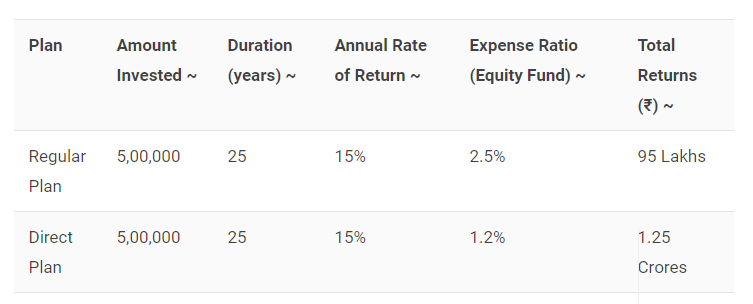

The table below gives a clear picture of how much more you earn when you invest in mutual funds with Direct Plans.

When you invest ₹5,00,000 for a period of about 25 years at an estimated 15% annual rate of return in an equity mutual fund using a Direct Plan, you end up earning around ₹30,00,000 more than you would with a part of a Regular Plan, for the same mutual fund.

If you invest the same amount using a Regular Plan, over a period of about 25 years, your broker (the AMFI-registered Mutual Fund Distributor who helped you invest) could end up earning around ₹30,00,000, which could otherwise have been yours.