From Dreams to Reality: A Comprehensive Guide to NRI Home Loans in India

NRIs may purchase residential and commercial property in India, but not agricultural land. NRIs may also purchase multiple properties.

Non-Resident Indians are able to get a loan to purchase the property, just as Resident Indians are. Similar to resident Indians, a loan can cover 70% – 90 % of the property’s value. The remaining balance must be covered by the NRI’s personal funds. It should be noted that the remaining balance must be paid in INR. There is no other acceptable currency.

NRI Checklist for Home Loans

1) Eligibility Criteria

Age – The majority of institutions expect applicants to be between 24 and 60 years old. For instance, Axis Bank requires applicants to be at least 24 years old, whereas ICICI Bank requires applicants to be at least 25 years old.

Work Experience – Banks expect the applicant to have worked abroad for at least six months. ICICI Bank requires a one-year waiting period prior to loan application. Different institutions have varying expectations for loan terms.

Income – Banks impose a minimum income requirement for loan applications. Axis Bank anticipates the income to be equivalent to at least 5,000 AED per month for GCC countries and at least 3,000 USD per month for the United States and other countries. Different countries and categories of employment have varying income levels.

2) Documents Required

Identity Proof – Any identification document, including PAN, Passport, Aadhaar Voter ID, and Driving License

Proof of Residence – Any document containing your Indian address, such as a passport, Aadhaar card, telephone bill, or driving license.

Proof of Income – Salary Slips (Salary Credits), Letter of Appointment, and Bank Statements where salary is received. If the NRI is self-employed, financial statements must be validated.

3) Property Transaction Documentation

Property documents including the Purchase Agreement and Letter of Property Allocation

- Construction permission (if applicable).

- Loan Application documentation

- Any receipts for payments made.

- Insurance policy documentation

4) Loan Amount/Fees

Varying institutions have varying minimum loan amounts and fees. SBI, for instance, provides a minimum loan quantity of Rs. 3,000,000. Typically, banks will lend up to 70% to 80% of the property’s value. Processing fees range from a rate of 0.25 percent to three percent. There are fees for both late payment and prepayment of the entire loan balance

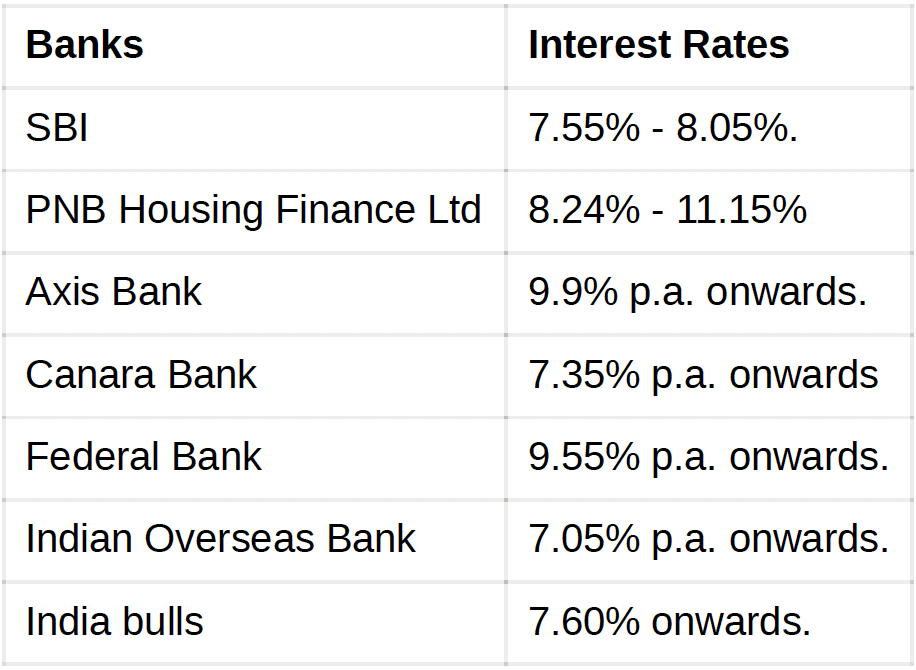

5) Interest Rate of NRI Home Loans in India

6) Tax Advantages of NRI Home Loans

Section 80C of the Income-Tax Act, 1961 allows NRIs who file taxes in India to receive tax benefits. Deductions are available for both interest and principal payments on a loan.

If your house is uninhabited in India and you have a mortgage against it, you may not be able to sell it. You are eligible for the following tax advantages.

Interest component: Deduction of up to Rs.2 lakh on interest amount installments.

Principal component: Deduction of up to Rs.1.5 lakh on repayments of the principal amount.

If the property has been rented out, the entire interest payable on the mortgage can be claimed as a tax deduction.

7) NRI Home Loan Repayment:

An NRI may repay the housing loan using remittances sent from abroad through conventional financial channels, an NRE/NRO account, or rental income generated by the property.

The loan can only be paid back in Indian Rupees. The repayment period can range from 20 to 30 years. In the case of ICICI Bank, for instance, the loan term depends on educational qualifications.

PNB has a maximum repayment period of 15 years for home purchase/construction and 10 years for home improvement loans.

There may be additional requirements or documentation depending on the bank that disburses the loan. Consult your bank to learn the precise requirements, eligibility, features, and terms.