How to Open an SBI FCNR Account as an NRI?

For Non-Resident Indians (NRIs) with financial ties to India, understanding FCNR accounts is crucial. This post explores FCNR accounts, their benefits, drawbacks, and tax implications offered by SBI.

What is an FCNR Account?

FCNR stands for Foreign Currency Non-Resident (Bank) Deposit. It’s a bank account in India specifically designed for Non-Resident Indians (NRIs) to deposit their foreign currency earnings.

Benefits of FCNR Accounts:

- Foreign Currency Deposits: These accounts allow you to hold your money in major currencies like USD, GBP, EUR, JPY, and AUD, protecting you from fluctuations in the rupee’s value.

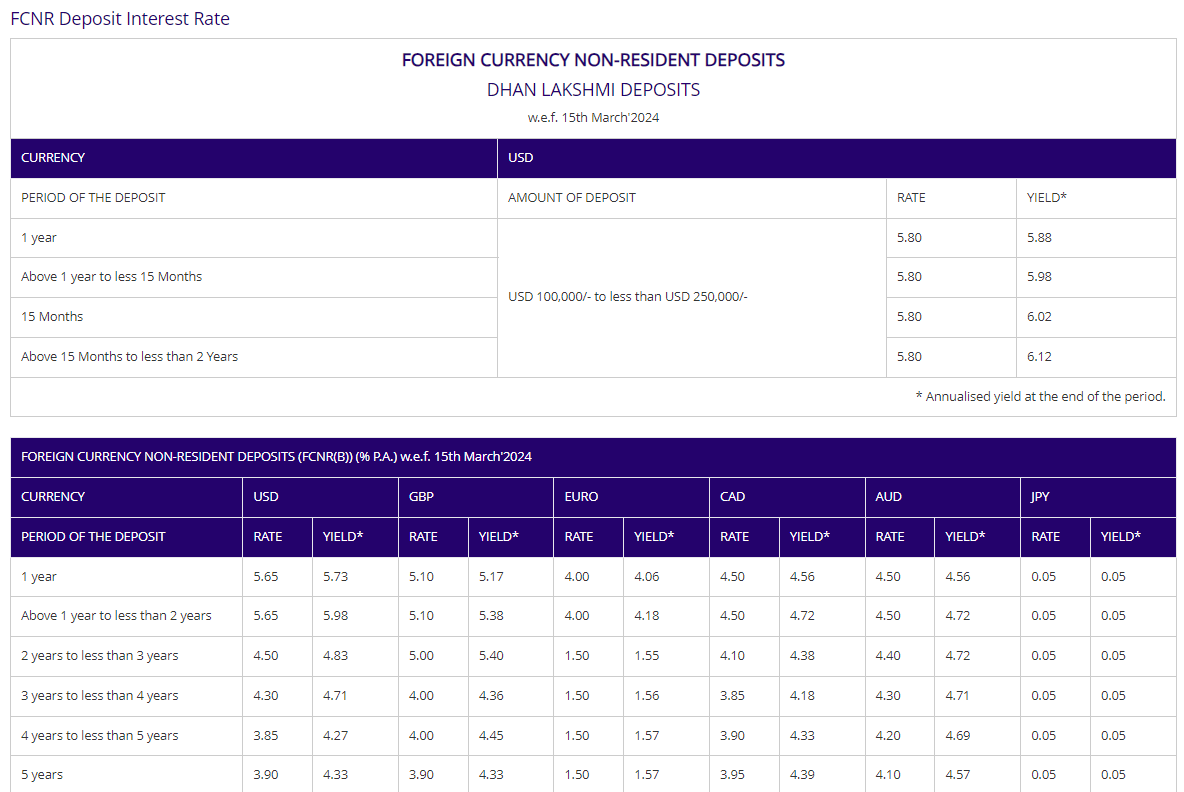

- Attractive Interest Rates: FCNR accounts typically offer higher interest rates than NRE accounts, which are rupee-denominated.

- Tax Benefits: Interest earned on FCNR deposits is generally exempt from Indian income tax, making it an attractive option for NRIs looking to grow their foreign currency savings tax-efficiently.

- Repatriation of Funds: The principal amount you deposit and the interest earned are fully repatriable, meaning you can quickly transfer them back to your overseas account.

- Flexible Tenure: FCNR accounts come with various deposit terms ranging from a few months to several years, allowing you to choose a timeframe that suits your financial goals.

Disadvantages of FCNR Accounts:

- Limited Liquidity: Unlike NRE accounts, funds in FCNR accounts are locked in for a fixed term. Early withdrawals may result in penalties and loss of interest.

- Lower Interest Rates Compared to Domestic Accounts: While offering higher rates than NRE accounts, FCNR accounts may have lower interest rates compared to some domestic fixed deposit options in India.

- Tax Implications in Country of Residence: Although tax-exempt in India, the interest earned on FCNR accounts may be taxable in your country of residence. Consult a tax advisor to understand your specific tax obligations.

Tax Implications of FCNR Accounts:

- India: Interest income earned on FCNR deposits is generally exempt from Indian income tax under current regulations. No tax is deducted at the source (TDS) from this interest income.

- Country of Residence: The tax treatment of FCNR interest income in your country of residence depends on their specific tax laws and any Double Taxation Avoidance Agreements (DTAAs) they may have with India. It’s essential to consult with a tax advisor in your resident country to determine if you owe any taxes on the interest earned.

Features of FCNR Accounts

The Tenor of Deposits (TDR / STDR) for FCNR (B) accounts entails a minimum period of 1 year and a maximum of 5 years. These accounts offer tax exemptions on interest income. However, taxation may apply upon relocation to India, contingent on the individual’s tax status. Deposits can be denominated in foreign currencies such as USD, GBP, EURO, CAD, JPY, or AUD. They can be opened individually or jointly with other NRIs / PIOs / OCIs. The principal and interest are in foreign currency, eliminating exchange loss concerns. Permissible account types include Term Deposits and Special Term Deposits, with funds sourced from fresh remittances from overseas or transfers from other NRE / FCNR (B) accounts or NRO accounts (subject to limit). Interest earned on FCNR (B) deposits is exempt from Indian income tax.

Foreign currency loans and rupee loans are also available against FCNR (B) deposits. These accounts allow joint ownership with close resident relatives on a “former or survivor” basis. Regarding premature withdrawals, no interest is payable if withdrawn before one year. After one year, the interest will be paid at the prevailing rate at the time of deposit, without any penalty, based on the remaining deposit period.

Premature withdrawals of FCNR(B) deposits

- No interest is payable if the deposit is withdrawn before one year.

- After one year, no premature penalty is charged for withdrawal. However, interest is paid at the rate applicable for the period the deposit remained with the bank.

- The interest paid is based on the rate available on the date of deposit.

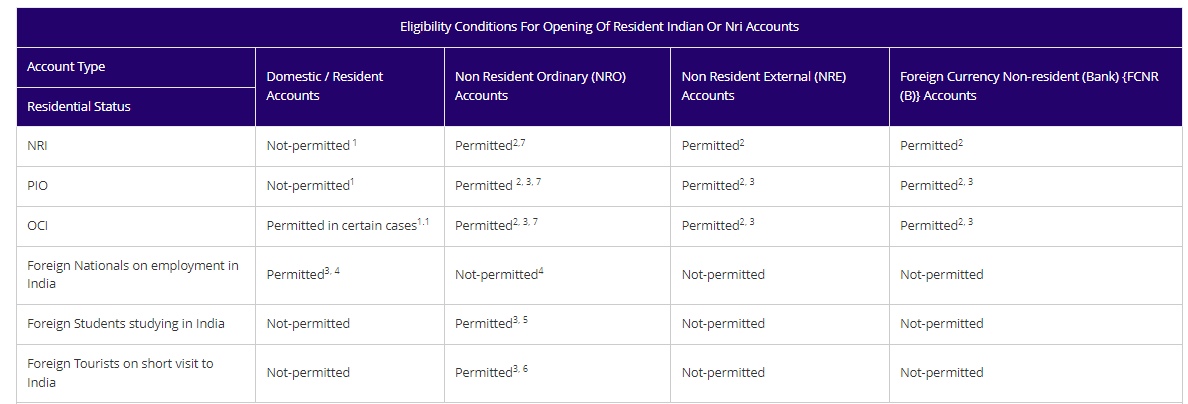

Eligibility Criteria to open an FCNR Account in SBI

(Source: https://sbi.co.in/web/nri/accounts/eligibility-fcnr)

Who can open an FCNR account?

(2) NRIs can open a joint account with a Resident Indian (RI) who is a close relative subject to the following conditions:

- The permitted operation mode is ‘Former (NRI) or Survivor’ only.

- The NRI (PIO / OCI) will be the joint account’s primary/first account holder, and RI will be the second applicant.

- Non-resident individuals, including NRIs/PIOs/OCIs, can establish and maintain joint NRE accounts with resident relatives on a “Former or Survivor” basis. The eligible relationships for joint accounts include:

- Members of a Hindu Undivided Family (HUF)

- Husband and wife

- Individuals related to each other in a prescribed manner, including:

- Father (includes step-father)

- Mother (includes step-mother)

- Son (includes step-son)

- Son’s wife

- Daughter

- Daughter’s husband

- Brother (includes step-brother)

- Sister (includes step-sister)

(3) Following conditions applicable:

- Pakistani nationals will require prior approval from RBI before opening the account.

- Bangladesh National to have a valid visa and residential permit issued by the Foreigner Registration Office (FRO) / Foreigner Regional Registration Office (FRRO) concerned.

Permissible credits

- Transfer from another NRE / FCNR (B) account is accepted.

- Transferring from another NRO account is permitted but with certain limitations.

- Fresh remittances from overseas through the banking channel are welcomed.

- Personal cheques drawn on foreign accounts can be deposited.

- Proceeds from Foreign Currency Notes or Travelers’ cheques tendered by NRIs / PIOs / OCIs during their visit to India are also allowed.

- However, amounts exceeding USD 5000 (or equivalent) in currency or USD 10,000/- (or equivalent) in Travelers’ cheques require a Currency Declaration Form.

Types of FCNR Accounts

There are two types of FCNR (B) Accounts available:

- Term Deposits (TDR): These accounts offer interest payouts every 180 days from the date of deposit. They involve foreign currency deposits with a fixed tenure and require a minimum deposit amount in various currencies like USD 1000, GBP 1000, EURO 1000, CAD 1000, JPY 100000 or AUD 1000. The principal and interest amounts are fully repatriable, and customers can nominate beneficiaries. Additionally, loans or overdrafts against the deposit are accessible, premature withdrawal is allowed, and automatic renewal occurs upon maturity at the prevailing interest rate.

- Particular Term Deposits (STDR): These accounts provide higher returns as interest is compounded every 180 days. Like TDR, they require a minimum deposit in foreign currency and offer full repatriability of principal and interest amounts. Customers can also nominate beneficiaries and avail loans or overdrafts against the deposit. Premature withdrawals are permitted, and automatic renewal occurs at the prevailing interest rate upon maturity.

- FCNR(B) Premium Account: These accounts provide a combined benefit of an FCNR (B) deposit with Forward Cover, which results in a higher yield. FCNR (B) deposits have a tenor ranging from 1 year to 5 years, while forward contracts span from 1 year to 5 years. The minimum deposit required for FCNR(B) is USD 10,000 or its equivalent, and the deposit will be made exclusively in USD currency. Forward contracts can be booked for the final return in INR, GBP, EURO, CAD, AUD, or JPY currencies without charges. However, in the event of cancellation of a forward contract by the depositor, cancellation charges and any exchange losses incurred must be borne by the depositor at the prevailing rate. Suppose an FCNR (B) deposit is closed before maturity. In that case, there will be no penalty for premature withdrawal, and the applicable interest rate will be as per the terms and conditions governing FCNR (B) deposits.

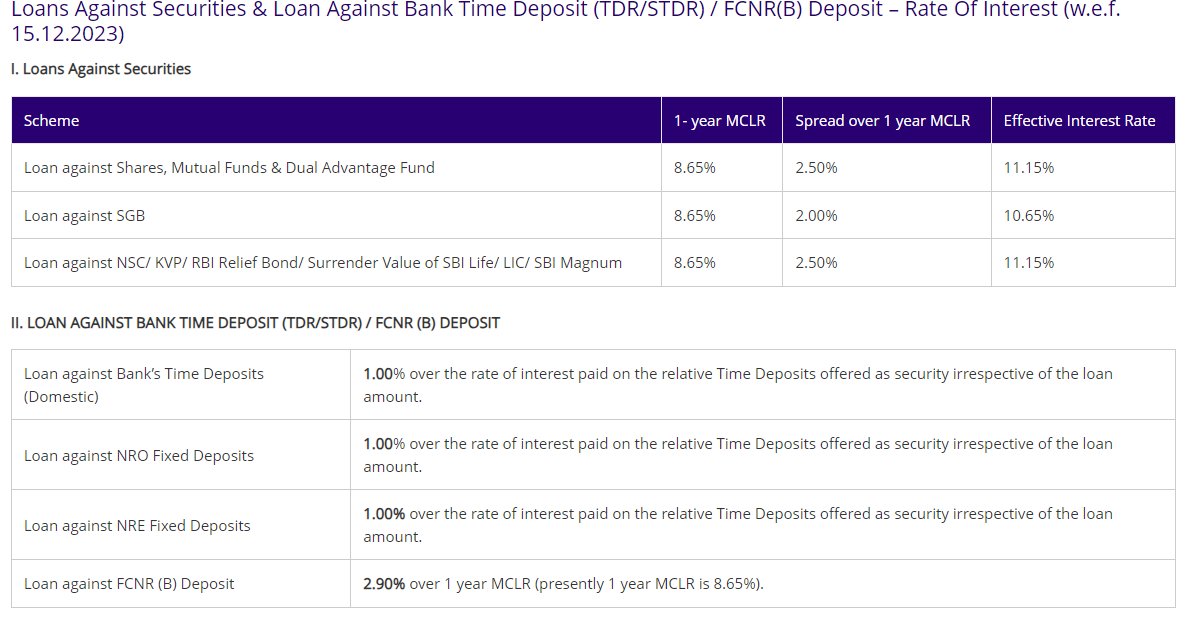

Loans against FCNR deposits

Customers can obtain a loan against FCNR (B) TDR / STDR deposits, either in Indian rupees or in Foreign Currency. They are not required to close the deposit to avail the loan prematurely. The loan can be obtained at the branch where the deposit is maintained, either as an overdraft or as a demand loan. The maximum loan amount is 90% of the face value of the deposit, including the interest accrued on the deposit. The interest rate for loans in Indian rupees is linked to the prevailing base rate

Funds Transfer From FCNR To Overseas Account

To transfer funds from FCNR (B) to an overseas account, you have the flexibility to choose between two modes:

- Through Internet Banking (INB): You can initiate outward remittances or funds transfer requests (forex) to yourself or a third party using the online banking platform. This can be done from your NRE Savings Bank account, NRE fixed deposit account, or FCNR (B) account to any overseas account. To proceed, you’ll first need to add a beneficiary and then submit a request for remittance in their favour. The beneficiary details are stored securely, allowing you to make multiple remittances to them subsequently.

- Procedure to add beneficiary for remittance: Login to your INB account

- Navigate to the ‘Profile’ tab.

- Enter your profile password.

- Access ‘Manage Beneficiary’

- Select ‘Outward Remittance Beneficiary for NRE / FCNR (B) Account’

- Enter beneficiary details and submit after OTP verification.

- Procedure for placing the remittance request: Login to your INB account

- Go to the ‘e-Services’ tab.

- Click on ‘NRI Services’ in the left column.

- Select ‘Outward Remittance from NRE / FCNR (B) Account’

- Enter the request details and proceed accordingly.

- Through Branch: Alternatively, you can download a standard request letter (https://sbi.co.in/web/nri/accounts/download-forms) for outward remittance from the FCNR (B) account. After filling it out, you can post or courier the letter to your home branch. Note that requests sent via email cannot be processed for security reasons.

Interest payable on deposits of a deceased FCNR (B) individual or joint depositor in the event of death is outlined as follows according to RBI Master Direction.

- If interest is paid upon maturity of the deposit, it will be paid at the contracted rate.

- Suppose the deposit is claimed before its maturity date. In that case, interest will be paid not at the contracted rate but at the rate applicable for the period the deposit remained with the bank without imposing a penalty for prepayment.

- Suppose the depositor passes away before the deposit matures, but the amount is claimed after maturity. In that case, interest will be paid at the contracted rate until maturity. Subsequently, simple interest will be paid at the applicable rate from the maturity date for the duration the deposit remains with the bank beyond the maturity date.

- In the case of a depositor’s death, the interest rate operative on the maturity date will be applied after the deposit matures, specifically for Savings Bank deposits held under the Resident Foreign Currency (RFC) Account Scheme. Interest will be paid from the maturity date until the payment date. Notional rates will be utilized when converting the FCNR (B) Account into an RFC / Resident Rupee Account, even if the deposit still needs to complete the minimum maturity period. Interest will be paid for the duration the deposit remains with the bank.

- If the claimants are residents, the maturity proceeds will be converted into Indian Rupees on the maturity date. Subsequently, interest will be paid for the following period at the rate applicable to a domestic Term Deposit of similar maturity.

Procedure to open an FCNR account in SBI

You can request the creation of an FCNR (B) deposit using any of the following methods:

- By sending fresh remittance from overseas: If you’re sending a fresh remittance from your overseas account to create an FCNR (B) deposit, include the following message in the remittance message section along with the necessary details:

- Specify the currency for the deposit (USD / GBP / EURO / CAD / AUD / JPY)

- Indicate the amount of deposit to be created.

- Specify the tenor of the deposit.

- Through Internet Banking (INB): You can initiate the creation of an FCNR (B) deposit by debiting your NRE or NRO account using the following procedure:

- Log in to your INB account.

- Navigate to the ‘e-Services’ tab.

- Select ‘NRI Services’ from the left-hand column.

- Click on ‘Inward Remittance Disposal Request’

- Enter the required details and submit the request.

- Through Branch: You can post, courier, or submit in person a request letter for the creation of the deposit by debiting your NRE or NRO account. You can download the standard request letter from the provided link.

A financial advisor can provide valuable insights tailored to an individual’s specific financial circumstances and goals. They help navigate through the varied investment opportunities and currency options available within FCNR accounts, ensuring compliance with both Indian and international tax laws. Moreover, advisors can offer strategic guidance on how to maximize returns and minimize financial risks, making the process of managing foreign currency assets more effective and streamlined. Reach out to us at [email protected]

This blog is for informational purposes only. The information here does not represent legal advice and should not be used as such. Please confirm the accuracy of any data or content from reliable sources on your own.