How to Open an SBI RFC Account as an NRI?

For Non-Resident Indians (NRIs) with financial ties to India, understanding RFC accounts is crucial. This post explores RFC accounts, their benefits, drawbacks, and tax implications offered by SBI.

What is an RFC Account?

The RFC (Resident Foreign Currency) account is a type of bank account that can be opened by individuals who come back to India after their stay abroad, by non-resident Indians (NRIs) and by persons of Indian origin (PIOs/OCIs) seeking to maintain foreign currency holdings in India, and those eligible for foreign exchange remittances like pensions, salaries, or proceeds from overseas asset sales. The RFC account allows the deposit of foreign currency funds and the receipt of foreign currency income such as pensions and dividends. It enables the conversion of one foreign currency to another approved currency or Indian rupees. It provides an avenue to invest in foreign currency-denominated assets and securities. It allows holders to earn interest on foreign currency deposits, thus enhancing the value of their savings. It also offers the flexibility of holding multiple currencies, making it easier for residents with international financial dealings to manage their money.

Key Features

- Currency: Maintained in foreign currency (USD, GBP, EUR, or JPY are common).

- Account Type: Current, Savings or fixed deposit accounts are available.

- Interest: Interest is earned and paid in the same foreign currency as the account.

- Repatriation: Funds are partially repatriable, with limitations on the amount that can be converted back to rupees and transferred abroad each year.

- Taxation: According to the account holder’s tax bracket, interest income is taxable in India.

Who can open an RFC Account?

- NRIs who:

- Returned to India on or after April 18, 1992, with at least one year of foreign residency.

- Are employed abroad for at least one year before returning to India.

Please note that the RFC account is not typically designed for residents of India who are earning from exports. RFC accounts are primarily for returning NRIs (Non-Resident Indians) who have switched residency status to India and want to manage their existing foreign currency holdings.

The reason for this is that:

- RFC accounts to cater to NRIs bringing back foreign currency earned abroad. Export earnings are considered domestic income and wouldn’t qualify for an RFC account.

- RBI (Reserve Bank of India) regulations specify that RFC accounts hold foreign currency earned outside India.

Advantages:

- Flexibility: Maintain savings in various foreign currencies.

- Repatriation: Freely repatriate interest income—limited repatriation of principal (up to USD 1 million equivalent per year).

- Investment Options (Limited): Some banks may offer foreign currency investment options.

Disadvantages:

- Taxation: Interest earned is taxable in India.

- Limited Repatriation: Restrictions on converting and repatriating the principal amount.

- Currency Fluctuations: Potential for losses due to currency exchange fluctuations.

Tax Implications:

- Unlike NRE accounts (tax-free interest), interest earned on RFC accounts is subject to tax in India according to the account holder’s tax bracket.

- Resident but Not Ordinarily Resident (RNOR) Status: If the individual qualifies as RNOR, the interest earned on the RFC account will be exempt from tax. RNOR status is a transitional phase between being a non-resident and a resident. As long as the individual maintains RNOR status, the interest income from the RFC account will not be taxable.

- Resident and Ordinarily Resident (ROR) Status: Once the individual transitions to ROR status, the interest earned on the RFC account will become taxable. Interest income from the RFC account will be subject to tax if the individual is classified as a resident and ordinarily resident in India.

- Tax Exemption for RNOR: It’s important to note that interest on the RFC account is taxable. However, if the individual qualifies as RNOR, they are exempt from paying tax on the interest income from the RFC account[2]. RNOR status provides tax benefits on interest income earned from the RFC account.

In summary, the tax status of the interest earned on the RFC account after transferring to the FCNR account will depend on the individual’s residential status in India. If the individual maintains RNOR status, the interest income will be exempt from tax. However, once the individual becomes a resident and ordinarily resident, the interest earned on the RFC account will become taxable.

Features of SBI RFC Account

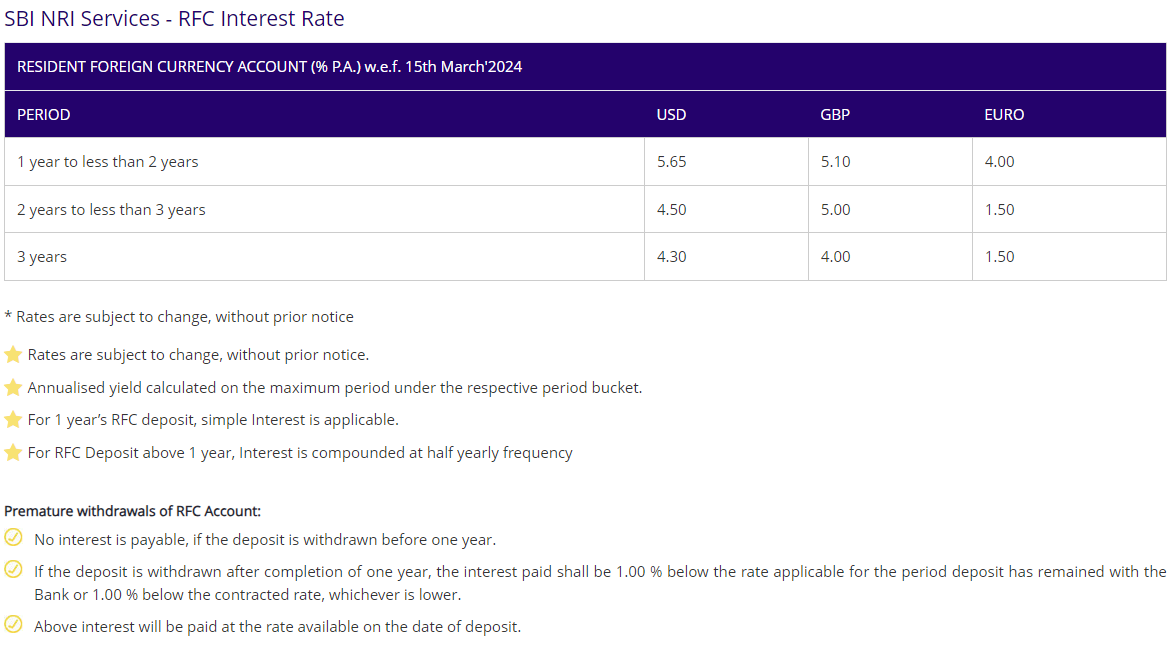

The Tenor of Deposits (TDR/STDR) terms stipulate a minimum duration of one year and a maximum duration of three years. If a withdrawal occurs before one year, no interest is payable. However, withdrawals after one year entail an interest rate of 1.00% below either the applicable bank rate for the deposit period or the contracted rate, whichever is lower.

Accounts in USD, EURO, or GBP are permissible and can be opened individually or jointly with another eligible person. The principal and interest are paid in foreign currency, eliminating exchange losses. Account types include Term Deposit and Special Term Deposit. Tax on interest earned depends on the account holder’s residency status (Resident or RNOR).

Furthermore, RFC accounts can be converted to FCNR (B) / NRE accounts if the holder regains NRI status.

Who can open an RFC account?

This type of bank account is designed specifically for:

- Returning NRIs (Non-Resident Indians): If you’ve been residing outside India for at least a year and have returned for permanent settlement, you’re eligible.

- NRIs Employed Abroad: As long as you’ve worked abroad for at least one year before returning to India, you can open an RFC account.

Process of opening an RFC account with SBI

To begin the process of opening an account, please download the account opening application by clicking here.

(https://sbi.co.in/documents/21077/23246/SBI_NRI_Account_Opening_Application.pdf)

Once downloaded, kindly complete the form manually, ensuring all required fields are completed accurately.

After completing the application, please gather the documents and proofs selected for KYC (Know Your Customer) purposes, as outlined in the application form. Ensure that these documents are attested copies.

Finally, you have the option to submit your completed application form and attested documents in one of the following ways:

- Post/Courier: Send the documents via post or courier to your home or preferred branch address.

- In-Person: Visit your home branch or preferred branch and submit the application form and attested documents directly to the designated personnel.

Additional Points:

- You can open an RFC account at any authorized bank in India that deals with foreign exchange.

- There are no restrictions on using the funds in your RFC account as long as they comply with existing foreign exchange regulations.

- In case of the account holder’s death, if a resident is nominated, the funds can be transferred to their rupee account.

Types of RFC Accounts

Term Deposits (TDR):

- Interest is paid every 180 days from the date of deposit. These deposits are designed for foreign currency deposits of fixed tenure, requiring a minimum deposit of USD 1000, GBP 1000, or EURO 1000.

- Both principal and interest amounts are fully repatriable, offering flexibility to account holders. Additionally, a nomination facility is available to ensure a smooth transition of assets in the event of unforeseen circumstances.

- Account holders have the option for premature withdrawal if necessary, with automatic renewal on maturity for the same period at the prevailing interest rate.

Special Term Deposits (STDR):

- STDRs provide an opportunity for higher returns, with interest compounded every 180 days. Like TDRs, they cater to foreign currency deposits of fixed tenure, with a minimum deposit requirement of USD 1000, GBP 1000, or EURO 1000.

- Like TDRs, both principal and interest amounts in STDRs are fully repatriable, and a nomination facility is available for added convenience.

- Account holders have the flexibility of premature withdrawal if needed, with automatic renewal on maturity for the same period, subject to the prevailing interest rate.

Non-Resident Indians (NRIs) should consider consulting a financial advisor before opening a Resident Foreign Currency (RFC) account due to the complex nature of financial regulations and the potential tax implications involved.

A financial advisor can provide valuable insights tailored to an individual’s specific financial circumstances and goals. They help navigate through the varied investment opportunities and currency options available within RFC accounts, ensuring compliance with both Indian and international tax laws. Moreover, advisors can offer strategic guidance on how to maximize returns and minimize financial risks, making the process of managing foreign currency assets more effective and streamlined. Reach out to us at office@primewealth.co.in

Disclaimer: This blog is for informational purposes only. The information here does not represent legal advice and should not be used as such. Please confirm the accuracy of any data or content from reliable sources on your own.