Mobile Money Transfers: A Convenient and Secure Way to Send Money from the US to India

The global mobile payment market has seen explosive growth, expanding from $1.48 trillion in 2019 to a projected $12.06 trillion by 2027. This tremendous increase in mobile payment usage worldwide has also led to a surge in fraud. As more people rely on mobile money transfers, robust security measures have become critical to ensure these transactions remain safe and trustworthy.

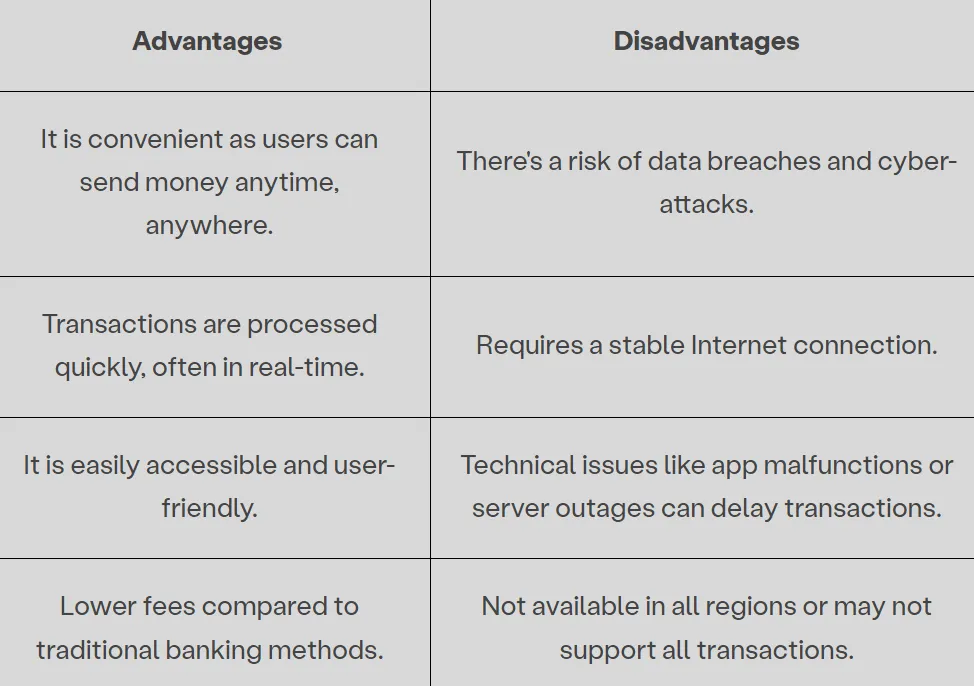

In this article, we will explore the topic of secure mobile transfers from the US to India. We will examine how these secure transfers work, as well as discuss their advantages and disadvantages.

Mobile Money Transfer

Mobile money transfers have revolutionized how we send and receive money. With the increasing popularity of smartphones and the internet, these digital transactions have become a convenient and efficient alternative to traditional methods like cash or checks.

How Do Secure Mobile Transfers Work?

Secure mobile transfers rely on several technologies to protect your financial information:

- Encryption: All data transmitted during a transfer is encrypted, making it difficult for unauthorized parties to access or intercept.

- Two-Factor Authentication: This adds an extra layer of security by requiring you to verify your identity through a secondary method, such as a text message or email.

- Tokenization: Sensitive information is replaced with a unique identifier (token), reducing the risk of data exposure.

- Secure Servers: Financial institutions and payment platforms use secure servers to store and process transactions, protecting them from cyber attacks.

Reasons for the Increase in Mobile Transfers

The rise in mobile transfers can be attributed to several factors:

- Increased Smartphone Usage: The widespread adoption of smartphones has made mobile payments accessible to a larger population.

- Growth of M-Commerce: The expansion of mobile commerce, especially in emerging markets, has driven the demand for mobile payment services.

- Convenience: Mobile transfers offer a quick and easy way to send money, make purchases, and pay bills without the need for physical cash or cards.

- COVID-19 Pandemic: The pandemic accelerated the shift towards digital payments as people sought contactless options to minimize physical interactions.

Different Ways to Transfer Money from Mobile in the US to India

- Mobile Banking: Many banks offer mobile banking apps with features like money transfers.

- Mobile Money Apps: Specialized apps like Vance, Wise, and Remitly allow you to send money using your checking account or debit card.

- Mobile Wallets: Google Pay can be used to store card details for payments and purchases.

Advantages and Disadvantages of Using a Mobile App for Money Transfers

Advantages:

- Convenience and accessibility

- Quick transaction processing

- Lower fees compared to traditional methods

Disadvantages:

- Requires a stable internet connection

- Potential for data breaches

- Technical issues can delay transactions

Essential Tips for Transferring Money from the US to India

- Compare fees and exchange rates: Choose a service with the best deal.

- Regularly check prices: Ensure you’re getting the most favorable rates.

- Avoid using credit cards: They often have higher fees.

- Consider transfer timelines: Some services offer instant transfers, while others may take days.

- Track transfers and verify details: Ensure the money reaches the correct account.

Conclusion

Mobile transfers offer a convenient and efficient way to send money from the US to India. By understanding the security measures in place and choosing reputable providers, you can enjoy the benefits of these digital transactions while minimizing risks.

FAQs

1. What security measures protect mobile money transfers?

Ans- Encryption, two-factor authentication, fraud detection systems, and secure PINs/passwords.

2. Are mobile money transfer apps regulated?

Ans- While there’s no specific federal law, they may be subject to regulations like the Electronic Fund Transfer Act or the Consumer Financial Protection Act.

3. How can I ensure my transfer is secure?

Ans- Use strong passwords, enable two-factor authentication, verify recipient details, monitor account activity, and update apps regularly.

4. What should I do if I suspect fraud?

Ans- Contact your bank or app provider immediately, freeze your account, change passwords, file a report, and monitor your account.

5. Are there any limits on transfer amounts?

Ans- While there’s no federal limit, individual banks or money transfer providers may have daily limits.

6. How do mobile transfer services verify identity?

Ans- They may use personal information, government IDs, selfie verification, phone number verification, and address verification.

7. How do mobile banking apps differ from mobile money apps?

Ans- Mobile banking apps are offered by banks for managing your account and making transfers. Mobile money apps, like Vance, Wise, and Remitly, focus on international transfers and often have better rates and lower fees.

8. Can I cancel a mobile money transfer once it’s started?

Ans- It depends on the service. Some services allow cancellations if the transfer is still in progress. However, once the money is processed or received, it usually can’t be canceled. Check your service’s cancellation policy before sending money.

9. What fees are common with mobile money transfers?

Ans- Typical fees include transfer fees, exchange rate markups, and extra charges for faster service. Some apps may also charge more if you use a credit card instead of a bank account. Always check the fees before you send money.

10.Do international rules or sanctions affect mobile money transfers?

Ans- Yes, transfers can be impacted by international rules and sanctions. Some destinations may have restrictions or need extra checks. Always ensure the service you use is allowed to send money to your chosen country and follows all regulations.