Mutual Fund SIP for NRIs – Why and How should NRIs Invest in SIP plans in India?

What is a Systematic Investment Plan (SIP) for NRIs?

SIP can be compared to a sip of water, metaphorically speaking. Small sips over a period of time allow us to comfortably consume the beverage. Investments through SIPs are somewhat similar.

SIP permits individuals to invest a fixed amount of money on a regular basis in mutual funds of their choosing. To activate a SIP, a monthly fixed amount will be deducted from the investor’s bank account and invested in their chosen mutual fund. By utilising SIP, an investor is not required to invest a large sum all at once; rather, his investments are segmented into small amounts that are paid monthly.

The Systematic Investment Plan instils in the investor a sense of financial discipline to set aside funds for periodic payments.

Benefits of Investing through SIP for NRIs

1. Emergency Fund – SIP is an investment and not a liability. Therefore, you can permanently or temporarily suspend them at any time. During the 2020 lockdown, many individuals halted their SIPs temporarily in order to survive the transient liquidity crisis.

2. Goal-based Investing – You can begin a SIP for any of your goals, whether they are a few months or decades away. You will never regret selecting the ideal fund with the help of your financial advisor and initiating a SIP in it.

3. Minimise Risks – Automated SIPS reduce the risks associated with human emotion, lack of discipline, and market cycles.

4. Keep a Record – Everything is possible online. Tracking of fund performance, portfolio analysis, investment returns, comparison with the benchmark, and transactions (SIP/SWP/STP registration, new purchases, and redemptions) are all possible from anywhere, at any time.

5. Greater Returns – Whether equity or debt, the long-term returns of mutual funds have exceeded those of the majority of asset classes. You can invest in any of the funds based on your financial objectives, risk tolerance, and time horizon.

Why not Lump Sum Investment?

For remarkable returns on lump sum investments, entry and exit timing must precisely coincide with the market cycle. However, nobody can precisely predict when the markets will cease falling or increase the majority of the time.

For instance, as soon as the news of the COVID-19 pandemic emerged in the middle of January 2020, global markets began to plummet until the fateful weeks of March/April 2020. Nobody knew when, where, or if the carnage would end. Since its apex in January 2020, the market has declined by approximately 50 percent. Only the bravest individuals would have ventured to invest further in these turbulent waters.

Importance of SIP for NRIs

1. Discipline – Due to the fixed date on which the SIP amount is routinely deducted from your bank account, you are compelled to save/invest before spending.

2. Goal-Directed Investing – Whether your objective is a few months or several decades away, you can begin a SIP for it. Choosing the appropriate fund for your SIP investment is a decision you will never regret.

3. Minimise Risks – SIPs reduce the risks associated with human emotion, lack of discipline, and market cycles because they are automated.

4. Rupee Cost Averaging – The NAV follows the prices of the underlying securities. Consequently, you receive fewer units during bull runs and more units during corrections. Because a SIP reduces your average investment cost, you profit from sustained bull or bear market phases.

5. Keep a Record – Everything can be completed online. Tracking of fund performance, portfolio analysis, investment returns, benchmark comparison, and transactions (SIP/SWP/STP registration, new purchases, and redemptions) are all possible from anywhere, at any time.

6. Flexibility –

Of Duration: The SIP duration can be tailored precisely to your objectives, ranging from a few days (in liquid funds) to decades. Even if there are no new investments, it is not necessary to redeem the units; your investment can continue to develop.

Of Fund House: There are 44 fund fund houses registered with SEBI to choose from.

Of Scheme: According to the SEBI classification, the fund institutions offer over 2,500 funds in 36 categories.

Of Investment: You can begin investing with a minimum of Rs 500 and Rs 100 per month.

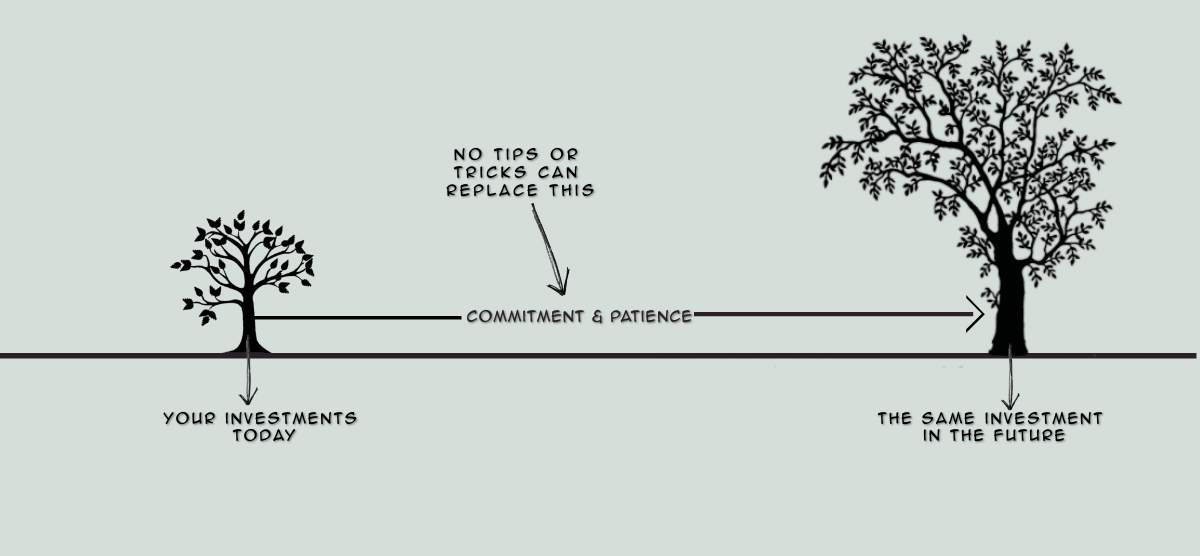

7. Compounding – Investing over the long term and remaining invested will help you realize the benefits of compounding.

8. Emergency – Fund SIP is not a liability but an investment. Therefore, you can permanently or temporarily suspend them at any time. During the 2020 lockdown, many individuals halted their SIPs temporarily in order to survive the transient liquidity crisis. In addition, if you haven’t invested in a scheme with a defined lock-in period, you can sell your investment whenever you need to.

9. Higher Returns – Whether equity or debt, the long-term returns of mutual funds have exceeded those of the majority of asset classes (although with greater volatility).

How Can NRI Invest in SIP Plans in India?

1. Account Creation

If you do not already have an NRI bank account, you should open an NRE or FCNR account. If you recently became an NRI or are about to become one, you can convert your regular savings account into an NRO account.

2. Documents required for KYC

The Mutual fund KYC process will require the following documents:

- Completed KYC form

- Passport

- PAN card

- Proof of Residence Overseas

- Proof of Address in India

- Recent photographs

- Bank statement

All documents must be attested by one of the following authorities:

- Officials of overseas branches of institutions enrolled with RBI

- Judicial or Notary officers of the country of residence

- Officials of the Indian Embassy or Consulate in the resident country

3. In-Person Verification

In-Person Verification (IPV) is a mandatory SEBI requirement. The Fund house, a KYC Registration Agency (KRA), or AMFI-certified distributors may perform this function.

In recent years, and especially during the pandemic, IPV has increasingly been conducted via live video conversation. A one-time password based on Aadhaar is used for verification, while a recorded video communication is used for authentication.

If you choose to invest using a power of attorney, you must first register the PoA. Second, both you and the holder of your Power of Attorney must meet the KYC and IPV requirements.

4. Finally, Invest

You can begin investing in any of their schemes once your KYC status has been updated in the fund house’s records. Depending on your requirements, you can create separate folios for numerous investments in the same fund house, or you can combine all of your investments under a single folio.