Pros and Cons of Private Equity Investments for Celebrities

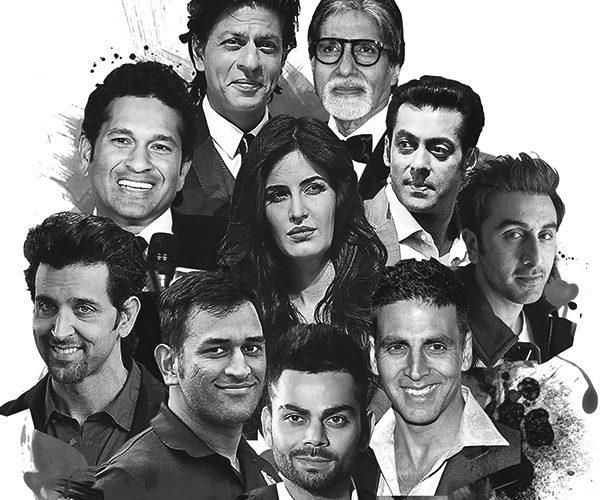

Image – Forbes India

Famous sportsmen and entertainers have been involved in venture capital as angel investors for a long time because they can be counted on as a reliable alternative source of income.

Professional athletes typically retire in their mid-30s, so many must make plans for the time when their main source of income will decline. Even few celebrities who are dependent on their skills might get affected as their age grows but few actor’s career might be unexpected.

However, some critics have criticised celebrities for utilising the private equity as a form of asset class. For example, Harvard Business School economist and author Josh Lerner previously noted that when inexperienced investors such as celebrities start piling capital into certain areas, it can be led to a creation of a bubble.

This was shown to some extent when Juicero, a business that was shut down in 2017 after receiving over $100 million from investors after their $700 juicing equipment was revealed to be completely redundant, was financed by Bryant Stibel, the venture capital firm of the late basketball player Kobe Bryant.

However, there is also a case to be made that famous people may enhance the value of their assets by using their insider knowledge of the business to provide strategic counsel.

So let’s have a look at the Pros and Cons of Private Equity investments for celebrities.

Pros:

- High returns: Private equity investments can potentially provide higher returns than traditional investments, such as stocks and bonds. This is because private equity funds typically invest in companies that are not publicly traded and have the potential for high growth.

- Diversification: Private equity investments allow celebrities to diversify their portfolios beyond their usual sources of income. This can help to reduce risk and protect against market volatility.

- Control: Private equity investments provide celebrities with a greater degree of control over their investments than traditional investments. They can work closely with the fund managers and have a say in the direction of the companies in which they invest.

- Prestige: Private equity investments can add a level of prestige to a celebrity’s portfolio, as they are seen as exclusive and sophisticated investments.

Cons:

- High risk: Private equity investments are typically considered high-risk investments, as they involve investing in companies that are not publicly traded and have a higher risk of failure.

- Lack of liquidity: Private equity investments are not easily bought and sold like traditional investments. They often have a long lock-up period, meaning that celebrities may not be able to access their funds for several years.

- High fees: Private equity investments often come with high fees and expenses, which can eat into the potential returns.

- Limited transparency: Private equity funds are not required to disclose as much information as publicly traded companies, which can make it difficult for celebrities to fully understand the risks and potential rewards of their investments.

In summary, private equity investments can provide celebrities with an opportunity for high returns and portfolio diversification, but they also come with high risks, limited liquidity, and high fees. As with any investment, celebrities should carefully consider their investment goals, risk tolerance, and overall financial situation before investing in private equity. Working with a certified financial planner will help celebrities make a well planned decision and also reduce risks.