Real Estate Investment in India: Opportunities and Challenges for NRIs

Recent projections indicate substantial growth in India’s real estate sector, with investments expected to hit 20% by 2025. The market is forecast to grow at 4.19% annually from 2024 to 2028, reaching a volume of $48.28 trillion by 2028’s end. This burgeoning market presents numerous opportunities for Non-Resident Indians (NRIs) seeking to invest.

Navigating Money Transfers for Property Purchases

While the prospects are enticing, transferring funds from Canada to India for real estate purchases involves complex legal requirements. Selecting the optimal transfer method can be challenging for such significant transactions.

Why Consider Indian Property Investment as a Canadian NRI?

The Indian real estate market offers attractive prospects for Canadian NRIs. India’s rapidly expanding economy drives consistent demand for residential and commercial spaces. The depreciation of the rupee against currencies like the Canadian dollar enhances affordability. Properties in tier-2 and tier-3 cities provide healthy rental yields, offering a stable passive income stream.

Investment Process for Canadian NRIs

NRIs can invest using funds from NRE, NRO Savings, or FCNR accounts in India, or through bank-to-bank and wire transfers. For mortgages, NRIs can secure up to 80% of the property value, with EMI payments possible through NRI accounts or direct remittances. The India-Canada Double Taxation Avoidance Agreement ensures NRIs avoid dual taxation on their investments.

Legal Framework for NRI Real Estate Investment

Key legal considerations include:

- Foreign Exchange Management Act (FEMA): Permits NRI investment in residential and commercial properties, excluding agricultural land and farmhouses.

- Reserve Bank of India (RBI) Guidelines: Allow investments through approved funding sources and repatriation of sale proceeds.

- Tax Implications: Rental income is taxable, but NRIs are generally GST-exempt unless they have a permanent establishment in India.

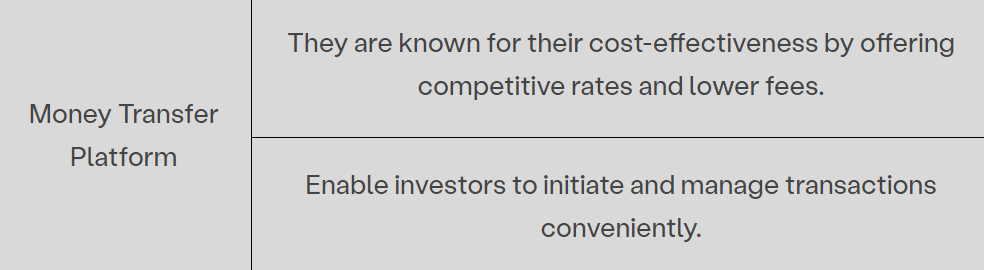

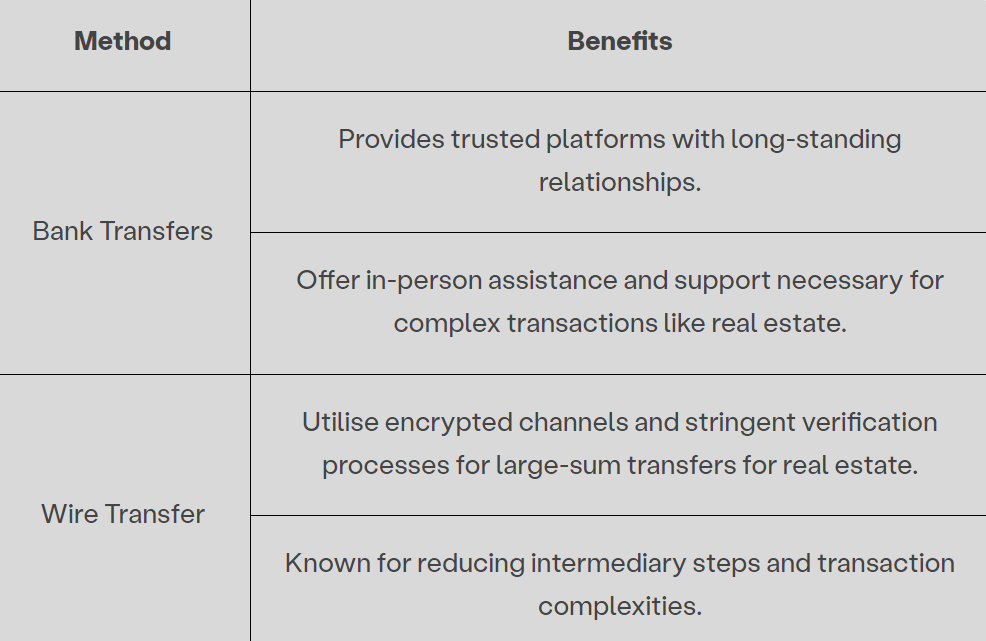

Optimal Money Transfer Methods

- Bank Transfers: Offer trusted platforms and personalized support.

- Wire Transfers: Provide secure channels and thorough verification for large transactions.

- Money Transfer Platforms: Known for cost-effectiveness and user-friendly processes.

Conclusion

While NRI real estate investment from Canada offers promising opportunities, it requires careful navigation of legal and tax considerations. Various transfer methods offer safety, speed, and convenience to simplify the process.

FAQS’

1. What legal and regulatory requirements apply when transferring money from Canada to India for real estate investments?

Ans- Key requirements include adhering to Foreign Exchange Management Act regulations, using authorized banking channels, and ensuring funds come from legitimate sources.

2. How can investors ensure compliance with both Indian and Canadian regulations for real estate money transfers?

Ans- It’s advisable to consult legal experts in both countries and maintain thorough documentation of all transactions.

3. What common challenges arise when transferring money for real estate investment, and how can they be addressed?

Ans- Challenges include fluctuating exchange rates, fund clearance delays, and complex regulations. These can be mitigated by researching optimal transfer methods, timing transfers strategically, or seeking expert guidance.

4. What role do real estate professionals play in the money transfer process for Indian property investments?

Ans- Real estate agents and lawyers facilitate transactions by verifying property title legitimacy, ensuring regulatory compliance, and offering guidance on tax implications.

5. Can NRIs buy any type of property in India?

Ans- NRIs can buy residential and commercial properties but cannot purchase agricultural land, farmhouses, or plantations as per FEMA rules.

6. What taxes do NRIs need to pay on property in India?

Ans- NRIs must pay tax on rental income from their property and capital gains tax if they sell it. GST is not applicable unless they have a permanent establishment in India.

7. Can NRIs transfer the money from selling property back to their country?

Ans- Yes, NRIs can transfer sale proceeds from up to two residential properties if they follow RBI rules, including using approved banking channels.

8. How can NRIs manage their property from abroad?

Ans- NRIs can hire property management services or give power of attorney (PoA) to someone to handle tasks like maintenance, tenant issues, and rent collection.

9. Can NRIs get a home loan from an Indian bank?

Ans- Yes, NRIs can take out home loans from Indian banks for up to 80% of the property value and repay using their NRI accounts or foreign remittances.

10.What documents do NRIs need to invest in Indian real estate?

Ans- NRIs need a valid passport, proof of address, PAN card, proof of NRI status, and property-related documents like the sale agreement and title deed.