Understanding NRI Lifestyle Inflation and How to Manage it

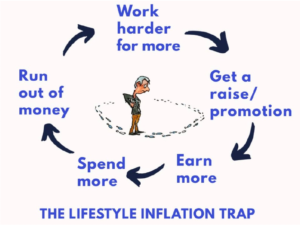

In the world of ever-increasing material desires, it’s easy to succumb to the allure of luxury when financial circumstances improve. This phenomenon is known as lifestyle inflation, and it affects individuals worldwide, including Non-Resident Indians (NRIs) who often experience an increase in income when working abroad. In this blog, we’ll delve into the concept of NRI lifestyle inflation, its potential pitfalls, and practical strategies to curb it.

Understanding NRI Lifestyle Inflation

When NRIs move abroad for work, they often receive higher salaries, sometimes accompanied by perks like housing and education allowances. This influx of disposable income can lead to a lifestyle inflation trap. Instead of allocating the surplus towards savings and investments, there’s a tendency to embrace a more extravagant lifestyle, influenced by the surroundings and the spending habits of peers.

The Pitfalls of NRI Lifestyle Inflation

1. Reduced Savings and Investments

Lifestyle inflation occurs when individuals’ expenses increase in proportion to their income growth. This phenomenon is particularly prevalent among NRIs, who often experience a significant increase in disposable income upon relocating to countries with higher living standards. While this newfound financial freedom can be enticing, it can also lead to a decline in savings and investments.

NRIs often face the temptation to upgrade their lifestyles, acquiring new possessions, indulging in expensive leisure activities, and living in extravagant accommodations. While these lifestyle enhancements may provide immediate gratification, they come at the cost of long-term financial security. By directing a significant portion of their income towards wants rather than needs, NRIs reduce their capacity to save and invest for future financial goals.

2. Difficulty in Adjusting

The inflated lifestyle that NRIs adopt overseas may not be sustainable upon their return to India. The sudden drop in income, coupled with the higher cost of living in India, can make it challenging to maintain the same level of spending. This abrupt shift from an inflated lifestyle to a more modest one can lead to financial stress and anxiety.

NRIs who have become accustomed to a certain level of comfort and convenience may find it difficult to downsize their expenditures. They may struggle to adjust to sharing a smaller living space, reducing their dining out frequency, or opting for more affordable entertainment options. This inability to adapt to a more frugal lifestyle can strain their financial resources and hinder their ability to meet their financial obligations.

3. Impact on Financial Goals

The failure to channel increased income into investments can have a detrimental impact on the achievement of long-term financial goals. NRIs often prioritise immediate gratification over long-term financial planning, leading to a shortfall in savings and investments. This lack of financial foresight can jeopardise their ability to afford a comfortable retirement, create an emergency fund, or support their children’s education.

By neglecting their financial goals in favour of lifestyle upgrades, NRIs risk facing financial hardship in the future. The absence of adequate savings and investments can make it challenging to cope with unexpected expenses, such as medical emergencies or job loss. Moreover, the lack of a secure retirement plan can force NRIs to continue working well beyond their desired retirement age.

Strategies to Curb NRI Lifestyle Inflation

1. Maintain a Balanced Lifestyle

While it’s natural to desire a comfortable lifestyle, it’s crucial to find a balance between living well and maintaining financial prudence. NRIs should create a budget that accounts for essential expenses while also allowing for saving and investing. Instead of replicating every aspect of your Indian lifestyle, consider exploring cost-effective recreational activities available in your host country. This approach promotes financial responsibility without compromising overall well-being.

2. Avoid Imitation

Resist the urge to imitate the spending habits of others, as their financial situations and priorities may differ significantly from yours. Instead of keeping up with the Joneses, focus on your own financial goals and make spending decisions based on your individual needs and aspirations. Not every overseas trip or luxury purchase is essential for happiness. Prioritise experiences that align with your values and passions, and avoid impulse purchases driven by societal expectations.

3. Define Life Goals

Take time to reflect on your life goals and identify what truly brings you contentment. This exercise helps you prioritise spending and align your financial decisions with your long-term aspirations. By setting clear objectives, you can ensure that your spending contributes to genuine satisfaction and fulfilment.

4. Set Financial Goals

Establishing clear financial goals provides direction and motivation for your saving and investment efforts. Define short-term, medium-term, and long-term financial objectives, such as saving for a down payment on a home, funding your children’s education, or securing a comfortable retirement. Linking these goals to your life objectives creates a roadmap for disciplined saving and investing, fostering financial discipline and purposeful wealth accumulation.

5. Avoid Routine Splurges

Occasional indulgences can enhance your quality of life, but regular splurges can quickly strain your budget and derail your financial goals. Reserve special treats for truly meaningful occasions to maximise their value and prevent them from becoming routine expenses. This approach promotes mindful spending and helps you stay on track with your financial priorities.

6. Increase Savings and Investments

Make a conscious effort to allocate a significant portion of your salary increments or bonuses to sound investment options. Prioritising retirement savings is crucial for ensuring financial security in your later years. Consider matching any salary increase with a corresponding increase in contributions to your retirement savings plan. This proactive approach maintains your current take-home pay while accelerating progress toward financial freedom.

7. Regular Expense Audits

Regularly review your expenses to identify any unnoticed areas of spending that may be creeping up. Small, recurring expenditures, such as daily coffee runs or frequent shopping trips, can accumulate over time. Utilise budgeting apps or maintain a detailed expense tracker to gain insights into your spending patterns. This practice helps you identify areas for potential savings and increases your awareness of your financial habits.

8. Debt Management

Prioritise debt repayment, especially as retirement approaches. Consider increasing EMI payments or making prepayments when unexpected financial windfalls occur. This proactive approach not only saves on interest payments but also enhances your financial flexibility and reduces the burden of debt in your later years. By adopting these strategies, NRIs can effectively curb lifestyle inflation, maintain financial discipline, and achieve their long-term financial goals. Remember, financial well-being is not about amassing wealth at the expense of present enjoyment; it’s about achieving a balance between living well today and securing a prosperous future.

Conclusion

While the allure of an improved lifestyle is understandable, NRIs must strike a balance between enjoying the present and securing their financial future. By adopting these strategies to curb lifestyle inflation, NRIs can live a financially stress-free and secure life. Remember, true happiness often lies in prudent financial choices rather than the accumulation of material possessions