Why Mutual Funds Sahi Hai?

You know how to earn, save money but confused while investing? Tired of comparisons, experiments, researches, enquiries and still not sure? Don’t worry, as per our experience with clients, it’s very common. While some want to stick to traditional options like RD, FD, gold, others wish to explore in financial markets for higher returns. But the barrier here is lack of knowledge. A solution to this can be mutual funds.

About 60% of our new clients do not know what mutual funds actually do, hence we thought of writing this for awareness.

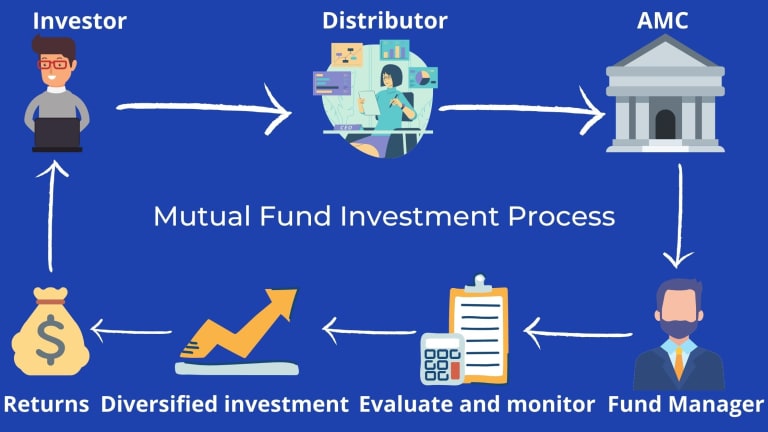

Mutual funds pool investors’ money, manage professionally to invest in the money market and securities. In simple words, many investors, retail or institutional pool their money in mutual funds, which are run by Asset Management companies like HDFC mutual fund, UTI mutual funds etc. These AMCs hire professionals known as fund managers to manage these funds, that is, invest in different financial products and the returns are given back to investors after deducting 1-2% fees.

The advantages of investing in mutual funds are:

-

Professional management: Experts manage your funds

-

Diversification: Even small amounts can be diversified

-

Liquidity: You can withdraw money at any time

-

Tax benefit: The dividends received in hand are tax free

-

Wide range of choices: You can choose schemes as per risk appetite, liquidity required and tax position

-

Higher returns: Typically ranges between 8-18% for long term investments

The process to invest in mutual funds is very simple:

Investors need to contact either distributors or directly AMCs. Distributors study investors’ risk appetite and liquidity required and recommend schemes. Since there are many types and options in every AMC’s schemes for example

As per portfolio:

- Equity: Small, mid, large cap

- Debt: Small, mid, large duration

- Hybrid

As per management:

- Active

- Passive

As per organisation:

- Open ended

- Close ended

- Interval

All the schemes are subject to market risks. Every scheme publishes its offer document. Investors need to read those documents. Distributors study these documents and performances so you can ask for advice.

Mutual funds are best solutions for those who want to invest in money markets and securities for higher returns but lack knowledge and time.