Estate Planning: Strategies Tailored for You

Let us guide you towards financial stability and wealth growth while you focus on building your dreams.

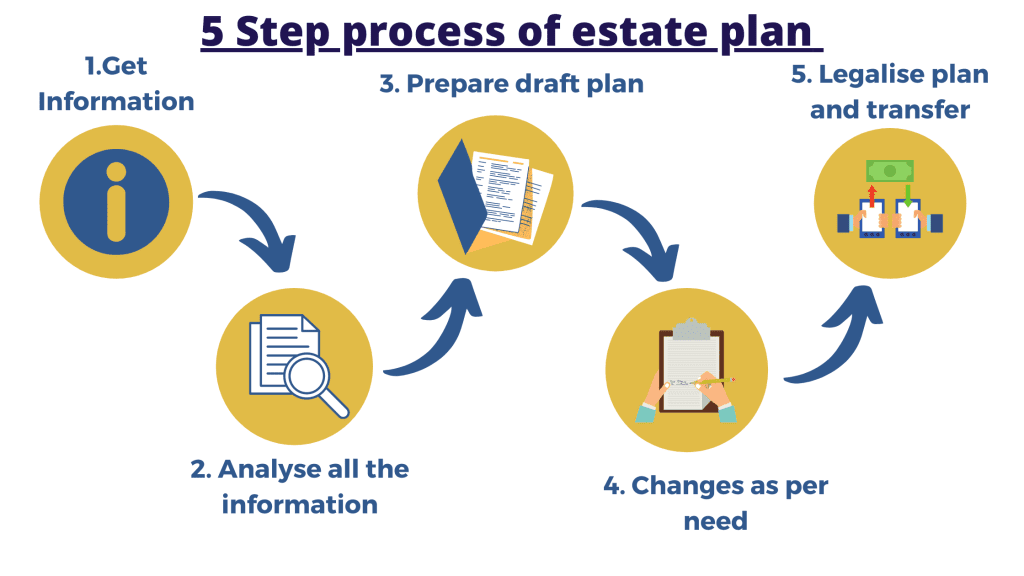

At PrimeWealth, we understand the importance of estate planning in securing your financial future and protecting your loved ones. Estate planning involves making critical decisions about the management and distribution of your assets, ensuring that your wishes are fulfilled and your family is provided for in the event of your passing.

Nobody wants to think about mortality. But Estate planning is just a process of transferring hard earned wealth to loved ones. It’s the biggest myth that estate planning is meant only for ultra- rich and/or is post-retirement process. Nominations not necessarily result in ownership. In absence of will, native succession law may be effective, and your loved ones may have to prove to be legal heirs. With estate planning, make sure your loved ones don’t suffer.

We offer a comprehensive range of estate planning services to meet your individual needs. Our experienced team of estate planning professionals will work closely with you to understand your goals, assess your assets, and develop a customized estate plan tailored to your unique circumstances. Our services include: Will Creation and Trusts, Estate Tax Planning, Asset Protection, Charitable Giving, Business Succession Planning.

Secure your financial future and protect your loved ones with our professional estate planning services. Contact us today to schedule a consultation and take the first step towards peace of mind and financial security.

You have Questions,

We have Answers

Whether you’re seeking clarity about our products, services, or policies, you’re likely to find the information you need right here. Explore the questions and answers below to enhance your understanding of our offerings.

First, it’s more than just an acronym. Unlike some designations that are worth little more than the paper they’re printed on, the CFP ® (CERTIFIED FINANCIAL PLANNER™) designation is one of the most esteemed financial certificates around. Each CFP ® is held to an extremely high standard and requires an immense amount of work. Typically nine months to two years of study. When you choose a CFP® professional, you can be assured that you’re working with a financial advisor who has demonstrated competency and made a commitment to ethics. CFP® professionals must successfully complete a multi-year, multi-step process to obtain the skills and real-life experience they need to serve your best interests, no matter what your financial goals are.

Yes , We help you reduce tax burden, plan for future taxes and also promptly file your taxes. Our In-house C.A specializes in helping service professional save on taxes and plan efficiently.

We don’t directly or indirectly hold your money in our accounts, we just help you to enable the transactions. We guide you to invest your money in various financial products according to your life goals. We provide a platform, where you will have the benefits to access to your investment accounts. We regularly mail statements to our client for utmost transparency.

We serve people from private service background. We specialize in advising IT professionals and their families as we have in depth clarity about their life stages and financial cycles. Anyone with an annual household income of more than Rs. 10,00,000 (both spouses combined) can opt for our services.

Distribution as Per Need

Transfer of estate as per individual needs of heirs and to those who care.

Will or Trust

Will or Trust, we suggest what suits best for you with legal compliance

Tax Efficent

Plan that complies local laws, efficiently mitigates taxes and complete control of funds

Transparent Advisory

A clear structure and transparent mandate that enables clients to pass on the heritage